A study on developers’ financial performance and operating strategies from 2010 to 2019

Contributed by Foo Chee Hung

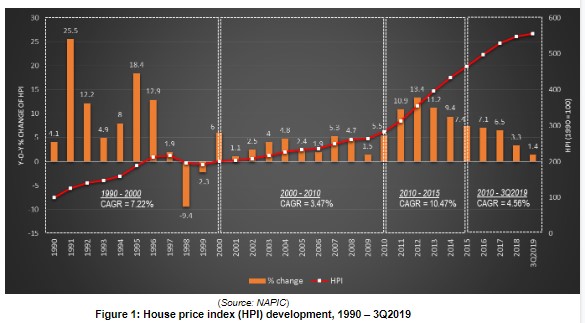

Malaysian house prices have been in a continuous upward trend since 1990, and the rise of house prices can be distinguished into three distinct periods based on the magnitude and drivers that caused the impact.

The drastic increase in house prices from 1990 to 2000 was mainly caused by two episodes of housing bubbles, which happened from 1990 to 1992 and 1994 to 1996. House prices’ increase from 2000 to 2010, on the other hand, was attributed to the house price growth that reflects the increase in the fundamental value of real estate, as well as the formation of a speculative herd instinct. The herd mentality was a result of higher income growth that exceeded the growth of house prices at the time.

The property market embarked on an explosive phase from 2010 to 2015, as prices started to escalate with a compound annual growth rate (CAGR) of 10.5%. This is mainly driven by the sentiment-induced mispricing, due to the favourable lending policy (like the developers’ interest bearing scheme and mortgage interest tax relief), market optimism from buyers as well as the drumming-up of market sentiment by developers. Since then, the recession phase kicked in (after 2015), marked by the mismatch of house prices and affordability, overhang in properties, cautious consumer sentiment, difficult access to property financing, and the weakened ringgit against other major currencies; in which the impacts are still profoundly affecting the country today.

Coupled with the unforeseen Covid-19 outbreak in January 2020 and the country’s political turmoil in February 2020, the property market slowdown is deemed to be extended throughout this year.

Property developers need to adjust their business strategies to withstand the economic challenges and uncertainties to stay relevant and competitive in the dampened property market. Since property developers are not homogeneous by nature, companies with different sizes and capital can have different business models, thereby adopting different operating strategies, and thus leading to varying responses to the market slowdown. This is well-depicted in the financial data and statement to shareholders in each company’s annual report.

As of February 2020, there are 98 public-listed property-related companies on Bursa Malaysia. While property development is one of the business activities of these companies, only 70 of them practice property development as their core business. The remaining are either mainly focus on property investment (eight companies), manufacturing (six companies), construction (five companies), hotel and leisure (four companies) or other businesses (see Table 1).

Table 1: Types of developers with different focus in business activities

Source: Company annual reports

To enable the companies’ response strategies to be linked to their financial performance, so as to understand how property developers adapted themselves during the recession phase, 47 companies were selected as a representative sample for further study. These selected companies have at least 60% of their revenue generated from property development in Malaysia. They have been listed since 2010 with traceable annual reports, and with no significant changes to the companies’ financial structure due to mergers and acquisitions. Also, no changes were made to their financial year that could lead to discontinuities in the reporting period.

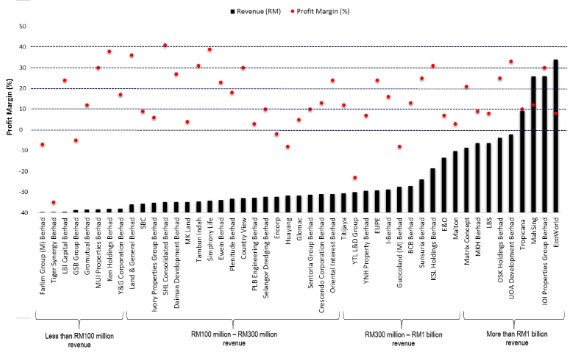

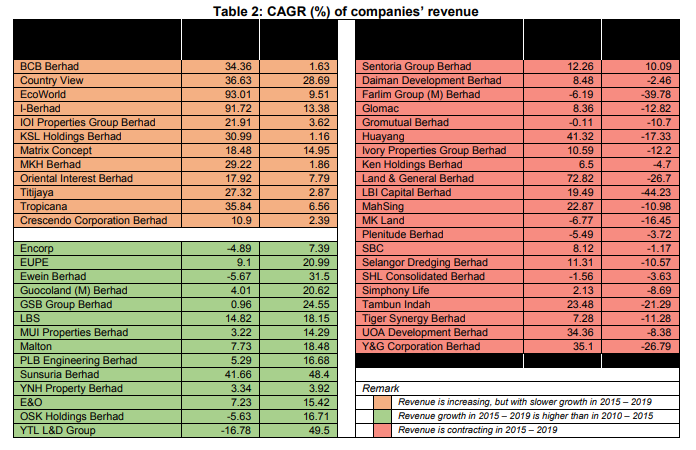

A study on the companies’ revenue reveals that most companies have doubled or even tripled their revenue in the 2010 to 2015 period, but with a rather challenging time from 2015 to 2019 as weak market sentiments and poor demand affected the property sales. In fact, the growth of revenue in property development companies has been declining from 2015 to 2019 as compared to 2010 to 2015, with an average CAGR of 17.38% and 2.47%, respectively (Table 2).

Though exceptions persist, companies experienced a contraction in revenue are those that achieved less than RM300mil revenue (highlighted in pink colour). Meanwhile, companies with more than RM1bil revenue tend to have slower revenue growth (highlighted in orange colour). This is in contrast to companies that achieved revenue of RM300mil to RM1bil (highlighted in green colour), as their revenues see exceptional growth with double digits from 2015 to 2019.

Such findings should not come as a surprise. Companies with more than RM1bil revenue are usually big and reputable developers that have gained a large portion of market share throughout their period of development. It is rather challenging for them further to expand their market share during the economic slowdown. In the case of companies that achieved a revenue of RM300mil to RM1bil, an exceptional growth with double digits is attributed to their business expansion strategy and diversifying business solution that enable them to outperform their competitors.

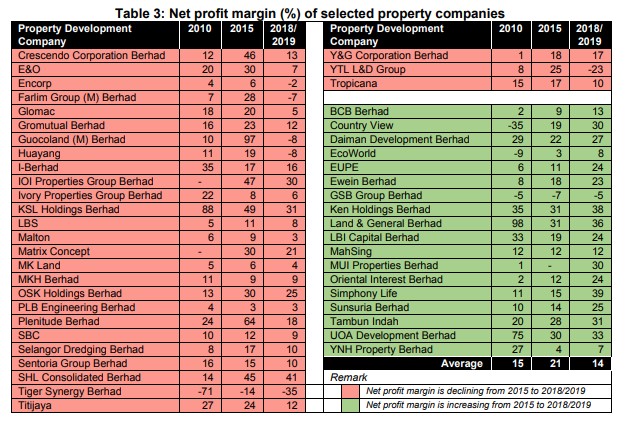

In terms of profitability, most of the companies have experienced a converging net profit margin. This is due to the reduction in revenue as well as the increase in the cost of doing business. In general, the net profit margin for developers has been declining towards an industry average of 14% in 2018/2019, as compared to its peak at 21% in 2015 (Table 3).

A further study on the companies’ profitability reveals that companies with smaller revenue tend to achieve higher net profit margin (Figure 2). This is because companies with smaller revenue are normally niche market players, where their main focus is on developing high-end market segment products in highly sought-after locations. For example, both Symphony Life and Ken Holdings Bhd, with the profitability of 39% and 38% respectively, have successfully branded themselves as high-end lifestyle developers. The possession of expertise in value engineering, as well as outstanding sales and marketing capability with local knowledge, have enabled them to boast a loyal group of customers who have confidence in their quality products and superior services.

Although some developers focused on the mid-market segment and had achieved high-profit margins like SHL Consolidated Bhd (41%) and LBI Capital Bhd (24%), these companies usually prefer landed properties more than high-rise stratified properties. This is because high-rise stratified properties are more capital intensive and carry higher risk. Most often, this type of developers will concentrate on developments that can generate cash flow for the company, such as landed residential developments, industrial lots, or shop lots located in decent areas.

Source: Company annual reports

Figure 2: Net profit margin (%) of selected property development companies in year 2018/2019

To further enhance the market presence, this type of developers will expand their development portfolio into landed township development, to lock in sales with a series of quick launches. Once the gestation period is over, earnings from the township will become more consistent and can become a main resource of cash for many years to come. Both KSL and Oriental Interest Bhd (OIB), for example, had successfully achieved profitability of 31% and 24%, respectively in 2018/2019, due to the improving margin of its landed residential properties.

While the profitability of companies with smaller revenue is high, some of them also incur higher losses like Tiger Synergy Bhd, Farlim Group (M) Bhd and GSB Group Bhd. This is in contrast to companies with more than RM1bil revenue, which are more consistent in terms of profitability. To note, the average profitability of these companies is 17.3%, as compared to 9.7%, 16.8%, and 9.3% for companies with revenue of RM300mil to RM1bil, RM100mil to RM300mil and less than RM100mil respectively.

During the market slowdown, larger developers – in terms of market share – tend to involve in integrated development with high-rise mixed residential and commercial offerings. This is of particularly true for companies whose main development activities are in Klang Valley region. The common theme in these companies is to sustain demand at the two ends of the price range, that is, high demand for affordable housing and elevated demand for luxury housing in prime locations.

Apart from that, other opportunities are also being explored to conserve precious capital. The most commonly adopted business mode is through joint-ventures or joint development agreements with landowners or government agencies. Often, the success of a development project depends on location, whether located adjacent to highways, commercial centres or preferred lifestyle areas such as parklands, riverine or lakeside environments. The ability to identify a prime location for land parcels, as well as having a strong liaison with the authorities for fast approvals and smooth compliance are the key factors for these companies’ overall performance.

Taking into consideration the challenging market trends, developers with slowing revenue growth or declining net profit margin have reported a review of their products. They are paying closer attention to the timing of launching, pricing and design concepts, with the focus, shifted towards clearing their stocks of remaining properties while gearing for the launches of the next phases of their popular residential developments in the previous financial years.

____________________________________________________________________

Dr Foo Chee Hung is currently the manager of Product Research and Development at MKH Bhd. Prior to this, he held the Head of Research position at the Construction Industry Development Board (CIDB). He has a PhD in Urban Engineering from The University of Tokyo. His research interest is in sustainability, affordable housing, green building, building quality assessment, Industrialised Building System (IBS), and urban ecosystem.

____________________________________________________________________

Disclaimer

This article is intended to convey general information only. It does not constitute advice for your specific needs. This article cannot disclose all of the risks and other factors necessary to evaluate a particular situation.

Any interested party should study each situation carefully. You should seek and obtain independent professional advice for your specific needs and situation.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.