Let FinDoctor.my be the guide for the right financing

For many Malaysians, securing a loan can be a daunting task. Imagine this: Ahmad, a first-time homebuyer, spent months searching for the perfect home. After finally finding it, he approached multiple banks for financing, only to face rejection from each one. This setback not only delayed his dream but also negatively impacted his credit score. Disheartened and unsure of what to do next, Ahmad found himself lost in a maze of financial confusion.

Does Ahmad’s story sound familiar? You’re not alone. Many Malaysians experience the frustration of loan rejections, unclear bank requirements and overwhelming paperwork. Whether it’s buying a new property, consolidating debts or securing a business loan, the uncertainty of loan approvals can leave even the most financially savvy individuals feeling adrift.

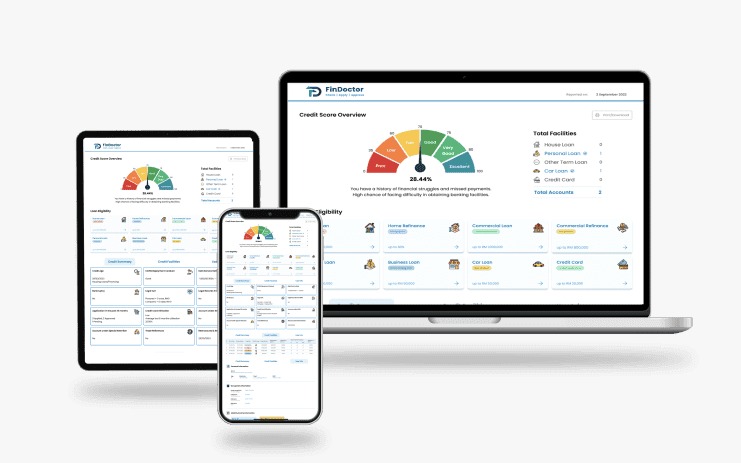

This is where FinDoctor.my steps in—this trusted AI-driven financial advisor is designed to simplify loan approvals, enhance credit health and unlock the best financing solutions tailored to your needs.

Common problems faced by Malaysians and how FinDoctor.my solves them:

- Problem: Multiple loan rejections

Many borrowers, like Ahmad, face rejections without understanding the reasons behind them. Every rejection impacts their credit score, further reducing their chances of future approvals.

Solution: With FinDoctor.my's loan eligibility screening, users can understand their standing before applying. The system checks your profile against all major banks, ensuring you apply only to banks that align with your financial profile, saving time and protecting your credit score. - Problem: Debt overload and cash flow issues

Business owners and individuals often juggle multiple debts, leading to high monthly commitments and cash flow problems.

Solution: FinDoctor.my offers a debt consolidation service, allowing you to bundle multiple loans into one manageable payment. This lowers your commitments, improves cash flow and boosts your eligibility for future financing. - Problem: Lack of transparency in loan offers

Comparing interest rates and loan terms across multiple banks can feel like a guessing game, with borrowers often uncertain if they’re getting the best deal.

Solution: FinDoctor.my provides users with access to real-time comparisons across 20 top Malaysian banks, showcasing the best interest rates, fees and terms in one convenient location. No more guesswork—just informed decisions. - Problem: Unclear bank requirements and application criteria

Many borrowers feel lost when navigating complicated bank requirements, leading to delays or rejections.

Solution: FinDoctor.my offers personalised credit advisory based on your financial profile, guiding you step-by-step through the eligibility and application process. With our insights, you’ll know exactly what needs to be done to secure approval.

Visit FinDoctor.my to experience how easy financing can be. For more information, contact Customer Service @ Hannah +6016 622 0163

Who can benefit from FinDoctor.my?

- First-time homebuyers: Secure pre-approval for housing loans to streamline your buying process and minimise the risk of multiple rejections.

- Small business owners: Easily access competitive financing options tailored to your business needs, empowering you to grow and thrive.

- Property investors: Optimise your loan packages to maximise investment returns and enhance your property portfolio.

- Individuals with multiple loans: Consolidate your debts to improve cash flow and increase your loan eligibility for future financing opportunities.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.