Rahim (centre) flanked by Sulaiman (right) and Rahim & Co estate agency CEO Siva Shanker holding their annual property market review.

By Joseph Wong

josephwong@thestar.com.my

KUALA LUMPUR: As the Covid-19 pandemic continues to plague the nation and the world, the efforts of property market stakeholders scrambling to adjust to the new norms is beginning to show some silver linings.

No doubt that 2020 was ridden with uncertainty, fear and nationwide lockdowns after being caught unaware by the Covid-19 pandemic, but 2021 is showing signs of shaping up to show a better adjustment.

The year-long pandemic situation had significant impact on the economic front, said Rahim & Co International Sdn Bhd executive chairman Tan Sri Abdul Rahim Abdul Rahim.

But unlike the previous crises like the Asian Financial Crisis of 1997/98 and the 2008 economic recession, the pandemic has a different effect, he told StarProperty after releasing their annual publication entitled Rahim & Co Research – Property Market Review 2020/2021 yesterday.

The review covered the property market performance for every state in the country for a year that saw many challenges.

Director of research Sulaiman Saheh added that 2020 as a whole, was a year of accelerated readjustment and technology adoption as well as a test on perseverance as people alike faced the odds of a global pandemic scare and precarious economic conditions highlighted by depressing growth rates and raised unemployment.

"Yet positive resilience and determination remained beneath the surface and in times of movement relief, demand came through as proof that the market is still there despite lockdowns and standard operating procedures.

"Optimism is held for the turning point to be in the latter parts of 2021 with the vaccine about to be mobilised, but with the more recent resurgence of cases and reimplementation of lockdowns, a further recovery delay to 2022 would not be a surprise,” he said.

Pandemic aside, he said pre-existing problems of unaffordability, oversupply and income levels to cost of living remain and need to be solved and tackled effectively.

Towards the end of the year, 2020’s gross domestic product (GDP) growth is forecasted to contract by 4.5% but with the production of vaccines and having survived through the initial pandemic shock, 2021 held a better recovery forecast of 6.5% to 7.5%.

Fall in transaction activities

For the property market, transaction activities fell by 15.8% and 21.6% in volume and value compared to the same period in 2019, coming to 204,721 transacted units worth RM80.71bil at as 3Q2020.

This had stalled the recovery trends in the property sector seen since 2018/2019 after several years of a lagging market.

In 2020, buyers sentiments were understandably hampered when Covid-19 swept in with its disruptive effect across almost all sectors.

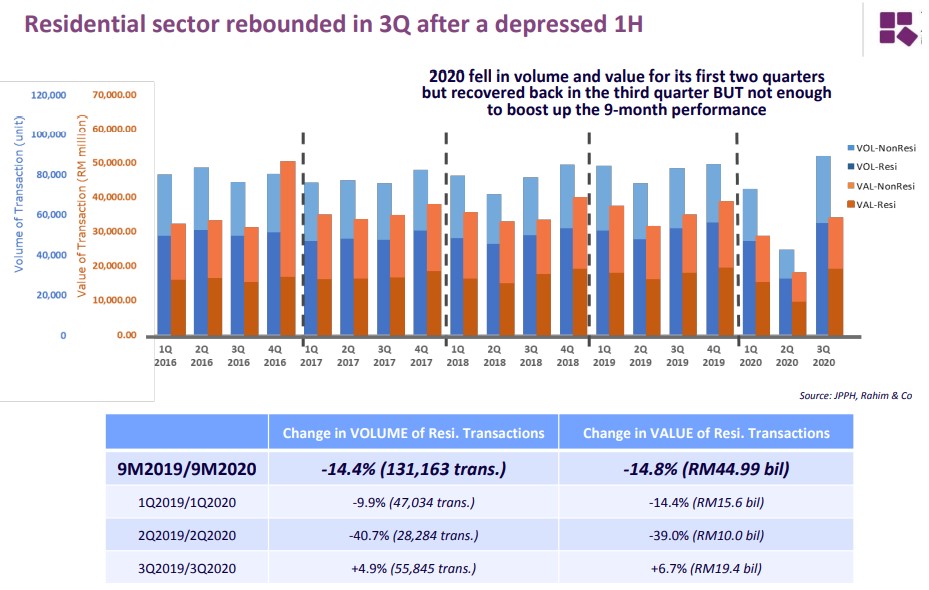

As the largest segment of Malaysia’s property market, the residential sector saw a decline in the first nine months of 2020 by 14.3% in volume and 14.8% in value in spite of a better year-on-year performance in the third quarter when the country entered the Recovery-MCO phase.

Progress in housing developments were disrupted and ultimately caused delays in completion targets, resulting in completion numbers to be 33.4% lower (at 64,080 units) than the previous period.

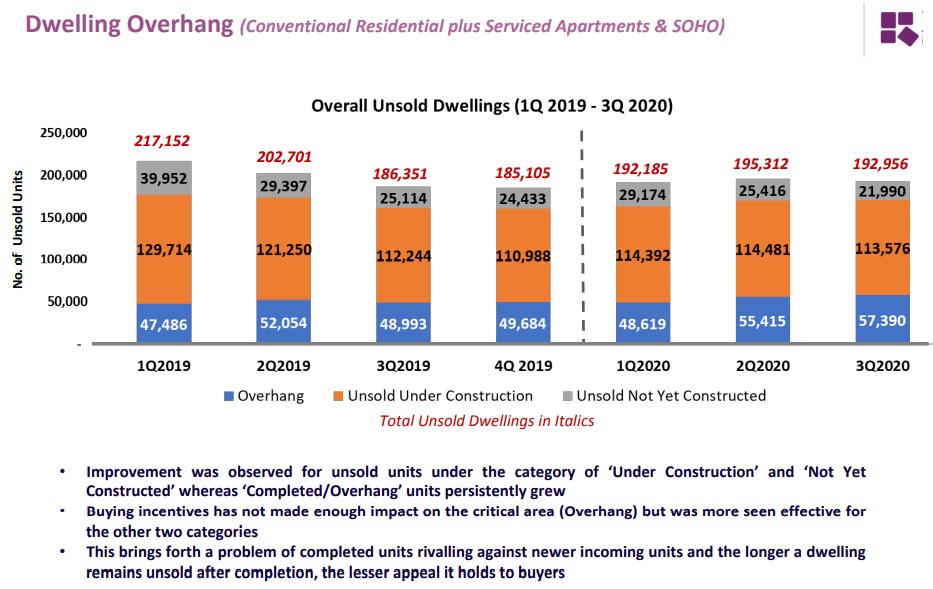

In addition, overhang numbers had also grown by 14.8% to 57,390 units worth RM42.49bil of dwelling units (residential, serviced apartment and SoHo combined).

“While this may be due to the pandemic's effect, the persisting overhang numbers is evident of a problem that is yet to be tackled effectively,” said Sulaiman.

Stimulus packages

In reigniting the market, the government had introduced various stimulus packages that amongst others were aimed at reducing the financial burden of homebuyers and easing homeowners to monetise their assets, said Abdul Rahim.

Through these packages, including the Penjana stimulus package and later complemented by the Budget 2021 announcement, the market saw the return of Home Ownership Campaign (HOC) 2020/2021, the exemption of Real Property Gains Tax (RPGT) and lowering of Loan-to-Value ratios that were intended to give the market a boost along with a moratorium for loan repayments.

Many developers opted for virtual sales tours and online sales medium in order to comply with the SOPs to catch up with their revised sales target amidst a pandemic that is still ongoing.

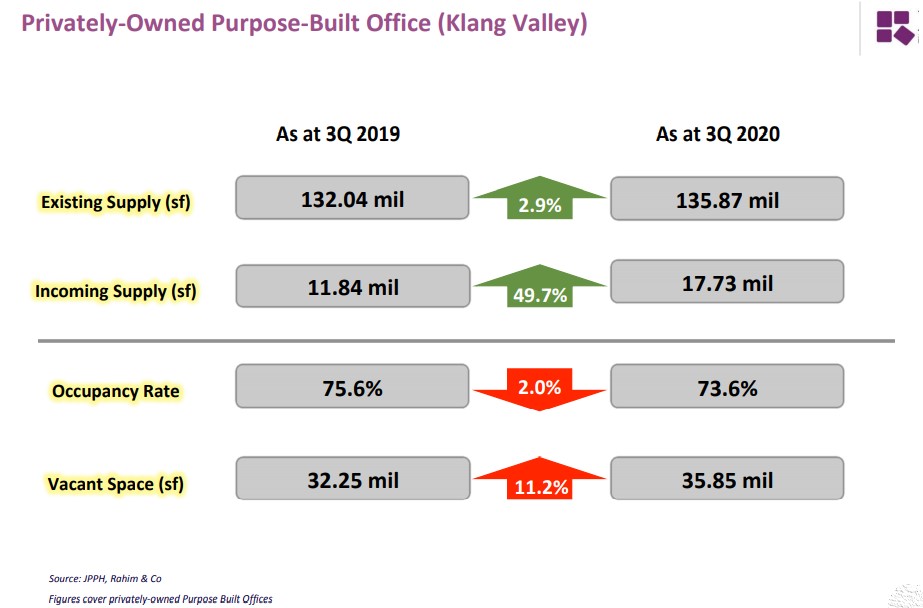

Rahim & Co also reviewed the office and retail sectors which had also seen their fair share of disruption and readjustment as social distancing and crowd restrictions impacted daily operations.

The two office market saw the establishment of the Work-From-Home (WFH) culture as the alternative norm to physical attendance.

With the practice of virtual office and remote operations, the adoption of technology in daily routines has been accelerated.

Shift in office demand

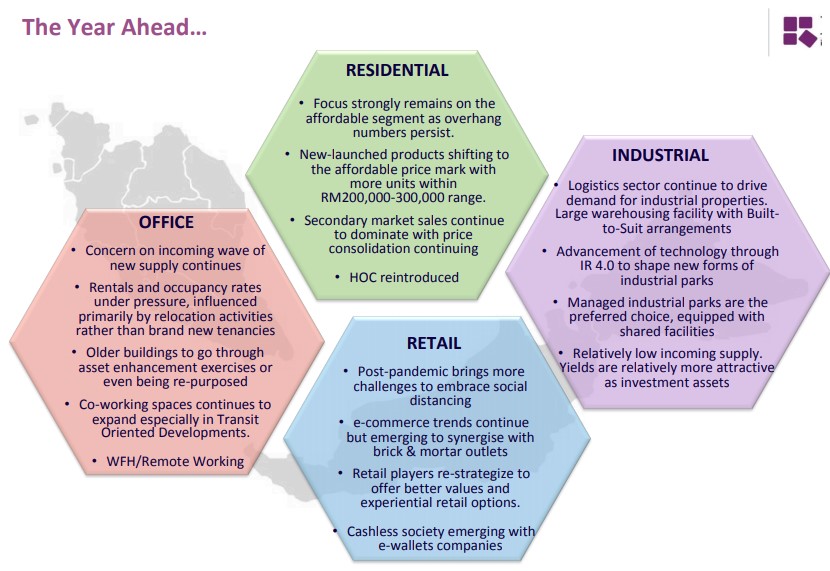

The shift in office space usage that was initially seen as a threat to demand for physical office should really be seen as an evolution in space demand whereby post-pandemic consumers would look for more flexible spaces and be more teamwork-oriented.

The need for physical interactions, necessary space separation and credible business addresses remain relevant for most businesses but are now expected in smaller portions and customisable tenancy arrangements.

Notwithstanding these trends, the office sector is still facing an oversupply situation with occupancy rates steadily dropping. This puts building owners under pressure to retain their rental yields.

Acknowledging a similar concern in the retail sector, the company highlighted that retail malls faced the challenge of volatile foot traffic and temporary closure periods on top of a rising vacancy that put the sector under further pressure.

Local consumers were plagued with daily case reports whilst international consumers were almost down to zero as cross border activities were significantly slashed.

But short bursts of relief were felt when movement restrictions were lifted, signalling a present yet suppressed demand market.

As with WFH, e-commerce and deliveries were fast moulding the new shopping trend as technology adoption was also accelerated. Mall operators now find themselves in an evolved environment that not only calls for new and innovative ways of improving the experiential aspect of physical shopping malls, but also ensuring the appropriate distribution of space for physical distancing as well as for retailers delivery service to their customers.

Industrial sector takes centrestage

Rahim & Co also highlighted that amongst the different property categories, the industrial sector is attracting more attention than others at present.

Despite having decreased by 29.8% and 11.1% in volume and value of transactions in the first 3 quarters of 2020, the industrial sector was still seen to be the more stable sector within a pandemic environment especially within the logistics, warehousing and healthcare segments.

This is boosted by the overwhelming demand for e-commerce transactions which will continue to hold the spotlight moving forward.

Considering the slower relative pace of incoming supply, especially for managed industrial parks with built-to-suit arrangements, industrial property investments are to be keenly observed this year.

As a whole, 2020 was a year of accelerated readjustment and technology adoption as well as a test on perseverance as people alike faced the odds of a global pandemic scare and precarious economic conditions highlighted by depressing growth rates and raised unemployment.

Yet positive resilience and determination remained beneath the surface and in times of movement relief, demand came through as proof that the market is still there despite lockdowns and SOPs.

Optimism is held for the turning point to be in the latter parts of 2021 with the vaccine about to be mobilised, but with the more recent resurgence of cases and reimplementation of lockdowns, a further recovery delay to 2022 would not be a surprise.

The pandemic aside, pre-existing problems of affordability, oversupply and income levels to cost of living remains and need to be solved and tackled effectively and holistically to ensure the long-term sustainability of the nation's property market.