Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. -Philip Roth

BY DATUK STEWART LABROOY

I RECENTLY attended the Asia Pacific Real Estate Association’s (APREA) Property Leader’s Summit held in Singapore. I enjoy this particular conference because I get to meet some of the top CEOs in the region and there is always the opportunity to make a deal happen. One session I attended that caught my attention was a panel discussion on the growth forecasts for China for 2016 and never before have I seen such a divergence of views – from bullish to bearish. One forecast put real growth at only 2%! Pretty scary stuff.

It made me realise that if we wish to make sense of our economy in Malaysia, we need to make sense of the regional and global economies. We are now part of a global economy and we have to take the consequences of being part of this global village. The ASEAN Economic Community (AEC) has yet to show how it can bring a positive spin to our own economy and the TPPA is still a mystery to many a lay man on the street.

Looking ahead to 2016, the view at this forum was just not optimistic at all - in fact it was very depressing. Malaysia’s growth was forecasted to be at 4%-4.3% up to 2020 and the ringgit was expected to spike to RM 4.70 to the US dollar in 2016 before recovering.

Warnings of a spike in imported inflation in 1Q 2016 is also a concern. This all points that we are still in for a rocky ride. Volatility is here to stay for a while.

Are REITs the answer as an investment thesis for 2016?

2015 Performance

First let’s see how they have fared so far this year.

M-REITs have generally come in within analysts’ expectations or slightly underperformed due to various reasons:

a. AXREIT: weak office/multi-tenanted segment

b. CMMT underperformed due to aggressive interest income estimates

c. IGBREIT exceeded expectations

d. Weak hotel segment for SUNREIT and KLCC due to softer consumer spending

Year-on-year, the gross rental income for M-REITs was mostly positive (2%-18%) and the sector’s 1H2015 core net profit grew 13% year-on-year, largely contributed by new assets (Axis REIT, MRCB Quill REIT) and organic growth via positive rental reversions (KLCCP, IGB REIT, Pavilion REIT).

Acquisitions drive the growth of the REIT counters but this activity has been muted post-GST within 4Q 2015, MREITs saw only three asset acquisitions to date:

1. Damen Mall by PAVREIT for RM488mil

2. Tropicana City Mall (TCM) and Tropicana City Office Tower (TCOT) by CMMT for RM540mil

3. Beyonics facility by AXREIT for RM61mil

The asset acquisition environment is slightly behind 2014 in terms of numbers of assets; 2014 saw six acquisitions, two from Sunway REIT and four from Axis REIT versus three assets in 2015. However, the total value of the assets acquired was higher in 2015 at RM1.1bil versus RM568mil in 2014.

The outlook for MREITs in 2016

The market view is that re-pricing of M-REITs would take place in 1Q 2016 and could continue throughout the year given the continuing volatile yield environment, and that we can expect to see some room for re-rating from 1Q2016 onwards once uncertainty over the US Fed’s interest rate hike and the ringgit volatility subsides.

However, strong domestic liquidity should provide support for M-REITs as M-REITs’ fundamentals are backed by steady organic earnings growth (positive rental reversions, space reconfiguration and stable occupancy rates) and healthy balance sheets of 0.14 times to 0.44 times gearing ratio. REITs’ good valuation buffers could cushion the impact of a sudden surge in bond yields.

I am optimistic that acquisition activity will pick up in 2016 as retail assets are trending closer to more realistic cap rate values of above 6.0% from 5.5%, while industrial cap rates are fetching better rates of 7%-8%.

With tightening liquidity, it is likely that sellers will be offering more realistic pricing to see an asset disposal going through as they try to de-gear their balance sheets.

The key to investing in M-REITs are the earnings stability but we need to aware of the challenges or concerns ahead for M-REITs

The key indicators investors have to be aware of are as follows:

A volatile bond market continuing into 1Q 2016: Investors may want to wait for the bond market volatility to settle down i.e. for the 10-year MGS to be closer to the 4.00% mark (highest at 4.45% in August 2015) before positioning to accumulate M-REITs.

Consumer sentiment: The market has factored in the impact of slow retail sales in 2Q15-3Q15 following the implementation of the GST. Soft retail sales may improve from 4Q onwards, as consumers begin to adapt to the new consumption tax three to six months after the GST implementation. However inflation may further dampen consumer sentiment next year.

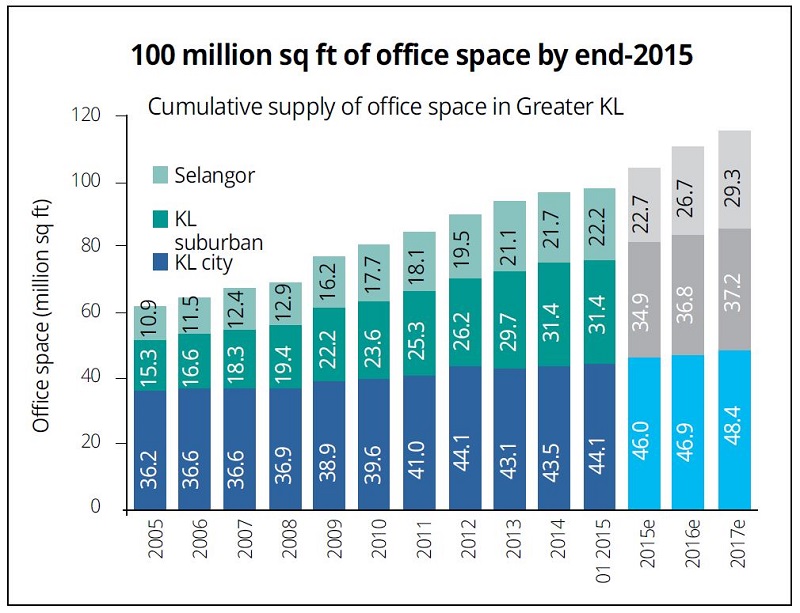

Lackluster performance of office sector set to continue: Given the influx of new office supply in the coming years, the office segment will continue to face a persistently challenging operating environment. Incoming supply of office space across Greater KL (excluding Putrajaya and Cyberjaya) is expected at:

• 2016: 6.8 million sq ft

• 2017: 4.5 million sq ft

Additionally, tenant retention would also be more competitive and multinational corporations (MNCs) are seen scaling back on expansion and holding back relocation plans amidst the current challenging economic environment.

So would uncertainty on US interest rates and the weakness of the ringgit affect M-REITs?

Foreign holdings of the MGS were still high at 46% as reported in August 2105, (down from 48% in July-15); it usually ranges between 44%-49%. As foreigners have been selling heavily in the equities market since early May, the view is that this may have also cascaded into the local bond market in August when bond yields spiked.

We also need to be aware of the narrowing yield gap between M-REITs and 10-year MGS. The 10-year MGS yield has been on the rise since Jan 2015 to 4.26% in November 2015 (highest at 4.45% in August 2015), triggered by foreign sell off of domestic bonds due to the weakening ringgit (approx. -20% YTD) and crude oil price (approx. -10.0% YTD). This has affected the appeal of the M-

REIT sector and led to a sell-down in M-REITs. As of 3Q2014, the average yield of M-REITs is 6.1%, or +185bps above the 10-year MGS yield of 4.24%. Unit prices of M-REITs have remained flat on average.

Further risks from external events could be triggered by the following:

(i) worse-than-expected consumer spending post-GST implementation

(ii) cost-push factors that may result in weak rental reversions

(iii) the US Fed increasing interest rates in a more aggressive than expected manner

(iv) further decline in oil prices and weakening ringgit, which may put increased pressure on the 10-year MGS.

Some advice for volatile times

It is hard to come up with an investment in M-REITs but most analysts favour those REITs with strategically located prime retail assets, such as KLCCP’s Suria KLCC, Pavilion REIT’s Pavilion KL Mall, IGB REIT’s MidValley Megamall and Sunway REIT’s Sunway Pyramid Shopping Mall, which have relatively stronger holding power for rental hikes.

For those operationally resilient M-REITs, the view is that they favour:

• Axis REIT’s portfolio of primarily single-tenanted, long-term, triple net leases

• KLCC’s long-term, triple net lease (TNL) offices and high-end mall that can weather the effects of GST better

• Pavilion REIT’s solid occupancy and prime asset positioning and

• IGB REIT may surprise on the upside if tenant sales manage to weather the effects of GST, which could be a positive for turnover rent and GRI.

>> Datuk Stewart LaBrooy is the former chairman of Malaysian REIT Managers Association.

>> Want to contribute articles to StarProperty.my? Email editor@starproperty.my