ACCORDING to AuctionGuru.com.my, the number of properties going under the hammer continues to move in an upward trend.

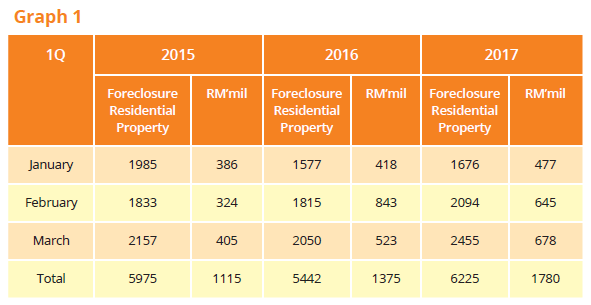

Based on data analysis of the property market, a total number of 6,225 residential properties valued at RM1.78bil were put up for auction in Q1 2017.

This constitutes a 31% increase from the same period last year, and a 61% increase compared to the year before.

The average foreclosure in each month comes to 2,075 residential units with an estimated value of RM600mil (See Graph 1)

ActionGuru.com.my executive director Gary Chia says that this trend is a result of several reasons, including curtailed domestic business activities, tightening of lending criteria by the local financial institutions and the elevated level of domestic household debt.

“We think that the staggering number of residential property foreclosure in Q1 2017 may also be due to investors experiencing financial constraints as rental yield is relatively low while capital appreciation is slow to materialise.

“This, in turn, is affecting their loan repayments. Besides that, existing home owners could be burdened by high financing cost.”

Chia reckons that the number of property owners facing foreclosure will continue to climb if the economy moves in the opposite direction.

“Some of them who lost their jobs have defaulted on their mortgages while beleaguered business owners are struggling to hold on to their assets,” he says, adding that many investors who entered the market during the property market boom are now in a bind because of the implementation of cooling measures.

The rise of private auction

Private auction is the practice of individual owners deliberately putting their properties up for sale.

According to Property Auction House executive director Danny Loh, this practice is becoming increasingly popular in Malaysia.

“These are not distressed or foreclosed properties; the auctioneers will help these homeowners who wish to sell their properties in the shortest time and at the best possible price.

“The terms and conditions of sale, in particular, and the reserved price will be determined by the seller,” Loh explains.

He elaborates that private auction provides openness and transparency.

“A public announcement about the property will be made during the auction; nothing is hidden.

“The crowd will then decide whether to make a bid based on the information available at the event.

“Sale of properties through private auction removes all possibility of manipulation as well as withholding and misrepresentation of facts by estate agents,” says Loh.

Caution during an auction

While we have all heard success stories about property investors making handsome returns from foreclosures, Chia cautions the people from jumping on the bandwagon.

“Our advice to the public is to be cautious in their investments because the property value is expected to remain subdued, notably in the category of commercial and office building, amid negative business sentiments and constrained household income growth.

“Highly-leveraged property investors may decide to deleverage or reduce their debt when their investment units are unable to generate sufficient rental income to meet their financial obligations.

"This will further aggravate and prolong the slowdown of the property market,” he explains.

Having said that, Chia believes that deeply undervalued property will emerge during this adjustment period and will resuscitate buying interest from investors.

Advantages and disadvantages

There are many advantages to buying properties at an auction, most notably is that you get a fair price.

Loh adds that home buyers could escape the often lengthy negotiations and tedious process of purchasing a new home.

More than that, there is no risk of property abandonment when buying a foreclosed property.

However, one cannot overlook the downside of distressed properties.

Loh says that under the terms and conditions of sale, auctioned properties are sold on an “as is where is" basis.

For example, because of the "as is" condition of sale, most times the buyers do not get access to the premises for inspection and evaluation.

Furthermore, there will be no vacant possession given, meaning that successful bidders have to get their vacant possession directly from the occupants.

“Moreover, there is a deadline given to the lucky buyers to settle the balance of the purchase price usually 90 to 120 days from the day of purchase. If not paid, the initial deposit will be forfeited,” says Loh.

“Lastly, outstanding charges such as maintenance fees, utility charges and quit rent must be settled by the successful bidder because these expenses are sometimes not borne by the banks,” he adds.

To minimise risks, purchasers should contact the auctioneers for more details about the properties put up for sale.

Important checkpoint

When buying a foreclosed property, Chia presents several caveats that should be given attention to.

“Always obtain a copy of the Proclamation of Sales (POS) and Conditions of Sale (COS) from the respective auctioneer or solicitor.

“Read through the documents to make sure that all the details are correct.

“Understand the costs to be undertaken and what will be excluded from the financial institutions or vendors,” says Chia.

He adds that it is advisable to conduct a title search on the foreclosed property to find out whether there is a private caveat filed by a third party.

Besides that, he warns purchasers to always check with the financier on the available loan amount for the property because the deposit paid for successful bidding is not refundable.

“There is no vacant possession for auctioned foreclosed property. The successful bidder has to evict the occupier of the property with his own costs and resources,” says Chia.

To learn more about property auction, log on to bit.ly/spauction.

To Read More: Hide and Seek of Property Auction

To Read More: 10 steps to buy an auction property

To Read More: Buying auction properties? Here’s a checklist before you bid

To Read More: Ask Me Anything: Auction property and stamp duty

How long does it take for a sale and purchase agreement of a property to be completed? Read the full article.