Safety net for your loved ones

By Viktor Chong

THE idea of defaulting on the loan payment is an unpleasant but real enough scenario that everyone should consider. This is especially so in the event that fatal accidents happened to the breadwinners that would no longer be able to support the family.

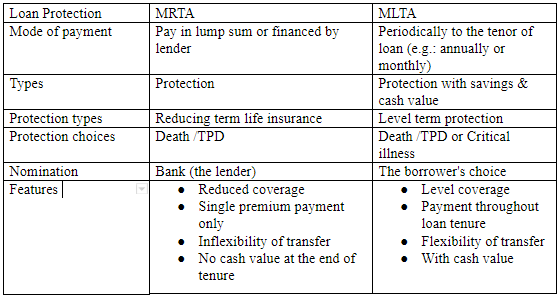

Hence, the mortgage life insurance is created to prevent your loved ones from shouldering the financial burden from the loan if circumstances such as death or temporary partial disability (TPD) occurs. Here are the two types of insurance to consider:

Definitions

MRTA:

Mortgage Reducing Term Assurance is a reducing term life insurance in which it serves to protect borrowers from death or temporary partial disability (TPD). The sum insured will slowly be reduced annually until it reaches zero at the end of the tenure. If anything were to happen during your mortgage period, the insurance company would only pay the claim according to that year’s coverage.

MLTA:

Mortgage Level Term Assurance is another option of loan protection in the market. The primary feature that makes MLTA different from MRTA is that the sum you have been assured will not be reduced during the length of the loan financing. The amount covered will remain fixed for the whole tenure. Therefore, you will not need to worry about the outstanding principal loan amount.

To understand better about the two schemes, Bancco Group Bhd managing director Jerry Tang shares his opinion regarding the subject.

MRTA:

“Starting with MRTA, it is suitable for those who intend to have only one house and the same lender for their entire life. It is an inflexible policy that does not allow you to reassign or transfer to another bank.

“MRTA would incur a higher cost when you attempt to procure a second property after disposing of the first. At an older age, MRTA will also cost higher, and the individual might not even be covered due to health-related issues.

“Further on, the borrower may also be at risk if the outstanding mortgage amount is more than the MRTA sum assured at the point of time. It is due to the floating base lending rate in Malaysia,” said Tang.homebuyer

If the claim occurs, the difference between the loan and sum assured needs to be topped up by the borrower (TPD claim) or next of kin (death claim). In this event, the borrower needs to ensure that the MRTA sum assured is always sufficient to cover the loan outstanding from time to time.homebuyer

MRTA is usually recommended by the lender as it is a relatively low-cost policy with only a single premium payment that can be financed into the loan. The sum assured with the tenure of coverage and other relevant factors such as age and gender will influence the premium.

Although MRTA is of lower cost for the borrower, it is only a basic reducing coverage plan. Therefore, it does not have any cash value at the end of the tenure. In other words, you will get nothing back.

MLTA:

Tang stated that MLTA is more suitable for young property investors who are aiming to go long-term with their investment.

“Personally, I would prefer MLTA products. Take note that the total premium payment is relatively higher as the premium is on an ongoing basis. In addition, you can also have a saving feature in your MLTA policy.”

“This feature enables a portion of the premium paid to accumulate as a cash surrender value. With the cash value policy, the borrower can surrender the policy earlier than the loan tenure and make use of the money to do an early settlement to the loan,” he said.

“For example, a borrower taking up an RM300,000 loan of 30 years tenure can also take up MLTA with cash value. The MLTA policy may have sufficient cash value in the 25th year to fully cover the balance loan outstanding of about RM110,000.”

“In this scenario, the MLTA policy’s cash value can help the borrower to enjoy five years of early loan settlement. The best part is saving on tonnes of interest from the loan,” he said.

Tang draws up two different scenarios to illustrate the differences:

Scenario 1: Mr. A

Age: 28

Loan amount: RM200,000

Tenure: 30 years

Monthly instalment: RM1,000.

Case Scenario: He is not buying any insurance but paying extra loan instalment at RM1,500 per month. That would shorten the loan tenure roughly to 25 years.

During the tenure of the 10th year, Mr A dies.

The bank will be chasing the next of kin to finance the loan. The inability to meet the demand will result in the property being auctioned off despite Mr A’s goodwill in paying extra along the tenure.

Scenario 2: Mr. B

Age: 28

Loan amount: RM200,000

Tenure: 30 years

Monthly instalment: RM1,000 with MLTA

Premium payment: RM3,600 per year = RM300 per month

Mr.B pays RM1,000 for loan instalment and RM300 per month for MLTA.

Assuming that the cash value at the 25th year is about RM55,000 and the loan outstanding at year 25 is also about RM55,000 ( interest rate unchanged throughout), Mr.B can surrender the MLTA policy to settle the loan entirely. It is an early settlement even though Mr.B did not spend extra in instalment payments.

Even if Mr.B dies during the loan tenure, the property is secured, and the next of kin isn’t burdened.

MLTA policies can also be transferred in the event of the insurer refinance or sales of his property. This flexibility to move allows the borrower to use the existing MLTA for a new loan or house. Furthermore, the individual can continue paying the same premiums and worry less about the new coverage application difficulties.

If the next property is more expensive than the latter, just add up the difference in premium. Adding to that, MLTA has features for multiple payment modes, either yearly, half-yearly, quarterly or even monthly, which might be able to relieve the high entry cost of buying.

Tang advised the property investors also to consider using MLTA as an adequate protection tool to enhance their wealth protection plans.

Tang’s opinion regarding the necessity of mortgage life insurance

"Along with my career in bank loan and property financing, I have seen many unfortunate incidents happening to my clients. Initially, I was pessimistic on asking my customers to pay extra for the entry cost of property purchase. MRTA or MLTA isn’t cheap if you are struggling to get your first house. However, after this incidents, it is my belief to persist in advising customers to take up MRTA or MLTA with sufficient coverage."

To Read More: Which type of first-time homebuyer are you?

To Read More: 12 steps to your first home

To Read More: Problems faced by first-time homebuyers

To Read More: 5 tips for first-time house buyers

To Read More: Choosing your first real estate agent

Interested in similar topics?

StarProperty.my will be coming up with an ebook titled “Looking for your first house? House-hunting tips in 2018.”.

Register at bit.ly/househuntingtips2018 to get a free ecopy.