A softening property market, bleak household sentiments, dwindling business confidence, cooling measures, drop in tourist arrivals and volatile commodity prices had impacted various property sub-sectors.

BY MAK KUM SHI

makks@thestar.com.my

ALTHOUGH economic sentiments have impacted various property sub-sectors in 2015, there have been silver linings, particularly in retail and offices.

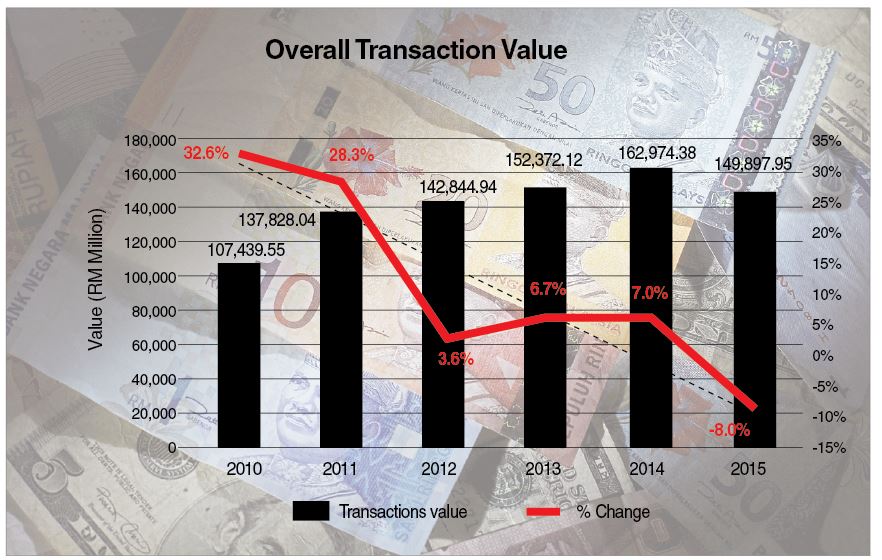

The National Property Information Centre (Napic) from the Ministry of Finance’s Valuation and Property Services Department had indicated a slight downturn in property market activity last year.

Market volume recorded at 362,105 transactions worth RM149.9bil in 2015, a marginal reduction of 5.7% in volume and 8.0% in value, compared to 2014.

The residential sub-sector recorded a slight downturn by 4.6% and 10.5% in volume and value respectively.

The commercial, industrial, agricultural and development land sub-sectors were also down by 10.6%, 13.0%, 7.5% and 2.4% respectively.

Bleak household sentiments

In line with the market softening and bleak household sentiments, the primary market reacted accordingly, as the number of new launches reduced to 70,273 units, down by 19.2% against 2014 (86,997 units).

Most states, particularly major ones, saw substantial declines in their new launches. New launches in Johor and Penang saw declines of 42.8% to 9,428 units and 47.5% to 2,348 units respectively.

The overall sales performance for the country hovered at 41.4% (29,089 units sold), lower than 45.4% (39,491 units sold) in 2014.

The residential overhang situation took a downturn as more units were recorded. There were 11,316 overhung units worth RM5.9bil, up by 16.3% in volume and 56.0% in value.

Holding 21.9% of the national overhang, Johor saw its overhang increased to 2,483 units. This increased by 8.5%, compared to 2014, due to higher unsold units in terrace and service apartment types.

On a similar trend, the unsold units under construction recorded an increase of 28.6% to 68,760 units, due to the large number of unsold condominium and service apartment units.

The fewer number of new launches partly helped contain the unsold units that were not constructed, down by 20.5% to 10,704 units.

Source: Ministry of Finance’s Valuation and Property Services Department’s Property Market Report 2015

Construction activities were generally on a low tone with the exception of starts.

Completions were down by 25.0% (80,850 units), whereas starts recorded a 10.3% increase over 2014, as higher numbers of service apartments in Johor Bahru (20,914 units) and Kuala Lumpur (13,197 units) commenced construction.

On the contrary, new planned supply was on a four-year low at 139,189 units, down by 31.8%. As at end-2015, there were 4.93mil existing residential units with nearly 0.89mil in the incoming supply and 0.64mil in the planned supply.

The Malaysian House Price Index sustained its moderating trend. As at Q4 2015, the Malaysian All House Price Index stood at 227.5 points (at base year 2020), up by 5.8% on annual basis.

The annual rate of increase for Malaysian House Price Index has been on a decelerating trend since Q4 2013, resulting from the various cooling measures to contain the spiralling prices.

On quarterly movements, the index points contracted by 0.8% against Q3 2015.

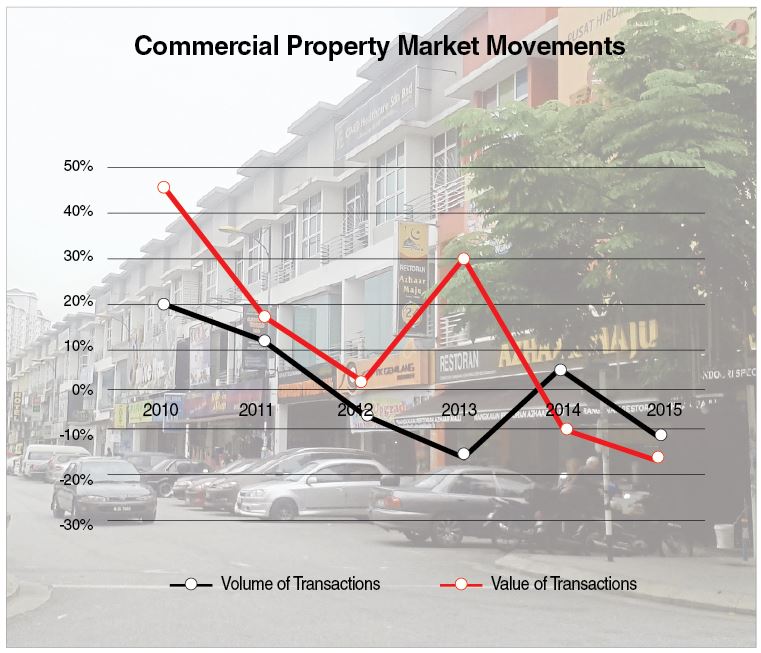

Lacklustre commercial sub-sector

There were 31,776 transactions worth RM26.4bil recorded, down by 10.6% in volume and 17.1% in value.

Major states recorded lacklustre performance with Johor recording the highest decrease of 21.9%, followed by Kuala Lumpur at 15.0%, Selangor at 11.1% and Penang at 10.7%.

In terms of transactions value, Penang had an increase of 19.0%, in spite of fallen market activity. Other major states succumbed to double-digit declines.

Dwindling business confidence

The shop sub-sector recorded 17,181 transactions worth RM13.31bil in 2015. This consisted 54.1% of commercial property transactions and 50.4% of the total value.

Compared to 2014, market activity was reduced by 14.7% in volume and 11.2% in value.

Penang and Selangor contributed higher market volume to the national total, each with 18.8% and 16.9% market share. Performance-wise, Johor recorded a drop of 29.3%, while Selangor saw a 10.0% fall.

The shop overhang recorded 4,972 units worth RM2.25bil, up by 15.0% in volume and 50.1% in value. Similarly, the unsold (units) under construction and not constructed were also on uptrend, nearly double the amount to record at 12,882 units and 2,459 units respectively.

Improvements in retail occupancy

The retail sub-sector recorded a slight improvement from 81.8% in 2014 to 82.4% in 2015, with a take-up amounting to more than 780,000 sq m.

Higher take-up spaces were observed in Selangor with more than 200,000 sq m, while Sarawak and Penang each secured more than 100,000 sq m.

Apart from Kelantan which recorded negative take-up rates, all other states recorded positive results.

Occupancy rates remained encouraging with nine states securing above 80.0% mark.

Kuala Lumpur saw a slight decline from 89.8% to 87.4%. Selangor improved further from 84.7% to 87.7%. Johor sustained at 74.8% compared to 74.9% in 2014. Penang improved to 71.8% from 66.1% in 2014.

Construction activity continued to see new entrants in the year. In terms of space, completions declined by 9.2% to record at 645,878 sq m.

Starts increased by 68.7% to 621,165 sq m as five complexes in Johor with a combined space of more than 200,000 sq m commenced construction.

As at end-2015, there were 13.83 mil sq m of existing retail space from 932 shopping complexes.

There were another 64 complexes (1.51mil sq m) in incoming supply and 38 complexes (1.03mil sq m) in the planned supply.

Selangor dominated the existing retail space while Kuala Lumpur dominated the incoming and planned supply.

Moderate performance for office sub-sector

The office sub-sector saw a slight downturn in the overall occupancy rate at 83.7%, down from 84.9% in 2014.

Although the annual take-up rate was positive at 262,202 sq m in 2015, it was lower than 867,979 sq m that was recorded in the previous year.

Occupancy rates for government buildings was at 98.7%, which helped to cushion the moderate performance of private office buildings at 78.5%.

Private buildings supplied nearly 75.0% of existing space and 70.0% of occupied space nationally.

State performance was commendable with 14 states having secured more than 80.0% occupancy.

Perlis obtained full occupancy and eight other states obtained more than 90.0% occupancy. The state office sub-sector was mostly dominated by government office buildings.

The new office supply was on an uptrend. There were 27 new completions offering a total space of 520,718 sq m, an increase of 17.3% against 2014 (443,792 sq m).

There were 16 buildings commenced construction (481,642 sq m), more than double the space recorded in 2014 (183,395 sq m). Seven of these starts were in Kuala Lumpur.

New planned supply, on the other hand, recorded eight buildings against 13 last year but did not run far in terms of space. Six of these newly approved building plans are in the capital city.

As at end-2015, there were 20.13 million sq m of existing office space from 2,434 buildings. There were another 62 buildings (1.67 million sq m) in incoming supply and 17 buildings (0.41million sq m) in planned supply. Kuala Lumpur dominated all three supply categories.

Tourist arrivals drop impacting leisure sub-sector

In tandem with the drop in tourist arrivals for 2015, the average occupancy rates of hotels saw a slight decline from 62.6% in 2014 to 61.0% in 2015, as reported by Tourism Malaysia.

The hotel sub-sector recorded 40 new completions (4,716 rooms), down by 29.5% when compared to 2014.

Starts recorded an increase of 12.3% to 4,340 rooms, but new planned supply decreased by 30.2% (4,342 rooms).

As at end-2015, there were 2,857 hotels across the country offering 208,747 rooms. Another 116 hotels (24,069 rooms) were in the incoming supply at a national level. Kuala Lumpur led other states with an incoming supply of 5,125 rooms.

There were another 85 hotels (16,341 rooms) at the planned supply stage.

Plateau in industrial property sub-sector

The positive performance for the industrial property sub-sector that was recorded in the first half of 2015 did not sustain till year-end. The industrial sub-subsector recorded 7,046 transactions worth RM11.97bil, down by 13.0% in volume and 17.5% in value.

Selangor continued to dominate the market, with 28.9% of the nation’s volume, followed by Johor and Perak, each with 16.1% and 9.6% market share respectively.

The industrial overhang saw a slight increase to record 243 units worth RM240.57mil, up by 7.5% in volume and nearly triple the value of 2014.

The significant increase in value was contributed by cluster industrial properties, which accounted for 45.6% of the national overhang value and were solely in Johor.

The unsold units under construction also observed similar trends, up by 29.7% to 1,731 units, whereas unsold units that were not constructed reduced to 87 units, down by 41.2%.

Remaining firm in 2016

While the global and local economic and financial environment is expected to be challenging this year, the recalibration of the Malaysian annual budget 2016 is intended to ensure the country remains firm to brave such challenges.

The residential sub-sector is expected to experience further softening in 2016, in view of various internal and external uncertainties foreseeable in the coming year.

Issues on affordable housing and affordability of home purchasers will continue to top the national agenda.

The measure that states that all new housing projects priced up to RM300,000 be limited to first-time homebuyers was recently announced in the budget recalibration.

The outlook for the commercial sub-sector is expected to be equally or more challenging when compared to the residential sub-sector.

The retail sector is likely to moderate as cautious sentiment on consumers’ spending is expected to continue due to increasing costs of living.

However, the performance of hypermarkets looks more positive due to the nature of goods, such as necessities, being sold in these premises.

The performance of the office market is expected to plateau. Downward pressure on rental may be felt by buildings, particularly those with tenants that are related to the oil and gas industry.

At the same time, the ample office space supply should send some cautionary signals to the authority before approving new developments.

The leisure sub-sector is expected to remain positive. The allocation of RM1.2bil to the Ministry of Tourism and Culture to implement programmes and events to achieve the targeted tourist arrivals at 30.5mil in 2016 may help support the sub-sector and industries such as hospitality.

The industrial property sub-sector is expected to remain moderate for the year.

The establishment of Principal Hub scheme, which offers multiple advantages to multi-national companies that uses Malaysia as a base for their regional and global business operations, will entail better prospects for the industrial sub-sector.

The flexibility of the scheme that allows companies to decide on the locations of their preference is another plus point for the sub-sector.

The agriculture sub-sector is expected to remain stable in the coming year. RM5.3bil allocated to the Ministry of Agriculture and Agro-based Industry for the proposed 2016 programmes is expected to support the sub-sector.

Several infrastructure projects such as public transport networks are expected to help boost values in areas where the networks run.

Such networks include the Ampang-Putra Heights, Kelana Jaya-Putra Heights and Bandar Utama to Johan Setia LRT Lines, Sg Buloh-Kajang and Sungai Buloh -Serdang-Putrajaya MRT Lines, Kuala Lumpur-Singapore High Speed Rail, and the Pan-Borneo Highway.

Although the property sector may see moderation in market activity for 2016, the slowdown would still be manageable.

The property sector will be able to endure this challenging period with adjustments and corrections expected from both the demand and supply side.

>> Mak Kum Shi is the content and consumer engagement manager for the property business unit of Star Media Group.