Understanding the four stages of real estate cycles

By Joseph Wong

Buying a home or investing in real estate is like navigating the shifting tides of the ocean. Just as the sea has its ebbs and flows, the real estate market follows a cycle of growth, stabilisation and contraction. For savvy buyers and seasoned investors, understanding this cycle is key to making informed decisions and timing strategies that yield solid returns.

There is also more than meets the eye when it comes to the real estate cycle's phases, just as the sea is influenced by the prevailing weather so too is the cycle subject to influencing factors ranging from economic conditions and demographic trends to government policies and technological advancements. Understanding these influences is crucial for buyers and investors to make informed decisions in a dynamic market, said Pejuang Hartanah founder Ahyat Ishak.

Empirical studies confirm that real estate markets follow a cyclical pattern, repeating phases over time as they respond to supply, demand, economic shifts and investor sentiment, he said. “Recognising where the market currently sits in this cycle can help buyers and investors forecast potential returns, manage risks and make buying decisions. The four primary phases of the real estate cycle—recovery, expansion, hyper-supply and recession—offer valuable clues about when to buy, hold or sell property,” said the seasoned property investor, public speaker and author.

Recovery: This phase marks the market's slow emergence from a downturn. While demand starts to build, supply is limited, keeping vacancy rates high and rent growth flat or negative. Signs of recovery are subtle, but low prices and quiet construction can indicate this phase. Investors who enter during recovery can secure properties at lower costs and benefit as demand grows.

Strategy: This is an ideal time to buy, as property prices are low and the market is positioned for growth. Investors should focus on properties with strong rental potential and plan for a long-term hold.

Expansion: In this phase, economic growth accelerates, driving demand for real estate. With increased job creation, rising gross domestic product (GDP) and higher consumer confidence, occupancy and rental rates begin to rise. Property values and construction activity increase as optimism returns to the market, creating prime conditions for investment.

Strategy: As property values and rental rates rise, investors can capitalise on short-term gains or hold properties for long-term appreciation. Expanding portfolios during this phase can be advantageous, especially in high-demand areas.

Hyper-supply: As enthusiasm peaks, overbuilding can lead to an oversupply of properties. During hyper-supply, vacancies rise and the rate of price growth slows as the market nears saturation. Developers may continue building due to momentum, but investors should proceed with caution and be prepared for a market adjustment. Rental growth remains positive but begins to decelerate as supply starts outpacing demand.

Strategy: Exercising caution is crucial during this phase. Investors may consider liquidating assets or holding only high-quality properties in desirable locations to ride out the downturn.

Recession: The cycle culminates in a recession when excess supply meets weakening demand. Vacancies soar, rental rates decline and new construction grinds to a halt. Property values fall and investor sentiment weakens. Recession can present opportunities to acquire undervalued properties, but only for those prepared to weather the downturn until the market recovers.

Strategy: This phase offers discounted property prices for those with a high-risk tolerance and patience. Investors should seek undervalued properties in locations likely to recover swiftly when the market rebounds.

Key influencers

A variety of elements shape the real estate cycle, impacting both residential and commercial property markets, explained Ahyat. “Understanding these factors allows buyers and investors to better navigate market changes and adjust their strategies accordingly,” he said.

The most common factors that influence property industry includes:

- Interest Rates: Lower interest rates make borrowing more attractive, fueling demand for property. Conversely, higher rates can deter buyers due to increased financing costs.

- Supply and Demand Dynamics: Real estate, like any market, is influenced by supply and demand. A scarcity of properties creates a seller’s market, while an oversupply shifts the advantage to buyers.

- Government Policy and Incentives: Government interventions, such as tax cuts, interest subsidies and favourable loan terms, can stimulate demand and invigorate sluggish markets.

- Demographic Shifts: Population growth, urbanisation and changes in household composition drive real estate demand, impacting property prices and rental rates.

- Economic Indicators: GDP growth, employment rates and consumer confidence all affect people’s willingness and ability to invest in property. A strong economy typically correlates with a robust real estate market.

- Market Sentiment: Perception plays a significant role in real estate. Media coverage, developer reputation and overall investor sentiment can sway market dynamics and influence buyer behaviour.

The real estate cycle as a predictive tool

Mastering the real estate cycle is invaluable for property buyers and investors aiming to anticipate market shifts and gauge the potential returns on investment. By tracking economic indicators, supply-demand trends and policy changes, savvy investors can refine their strategies to navigate inevitable market fluctuations. With a focus on timing and adaptability, buyers and investors can make well-informed decisions that maximise returns while minimising risk, Ahyat pointed out.

In today’s dynamic market, technology and data analytics offer unprecedented clarity, empowering investors with tools to assess cycles and make strategic choices. As the tides of real estate continue to shift, staying informed and adaptable is essential for seizing opportunities.

Is the market booming?

Economic factors have a substantial impact on real estate. During periods of economic growth, demand for real estate typically rises as job creation accelerates, drawing people to urban areas and driving up property prices and rental rates. Conversely, in economic downturns, demand slows, credit conditions tighten and property values decline.

For housing demand to sustain, purchasing power must increase. Without this, rental rates and demand for new homes may fall, impacting both developers and investors.

Real estate cycles vary by region and country, cautioned Ahyat. In the residential sector, studies show growth phases often last four to seven years, followed by downturns of three to five years. Understanding these local cycle durations can help investors better time their entry and exit points.

Over the last decade, the property industry has been under a number of headwinds from economic factors to the outbreak of a pandemic but post Covid-19, the market has been slowly but surely mending itself, noted Ahyat.

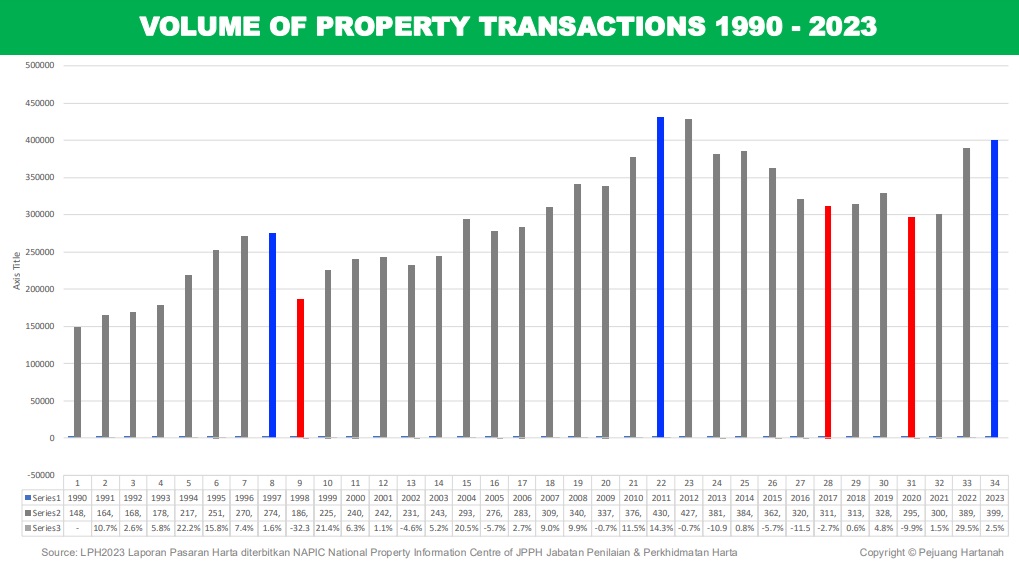

“Interestingly, 2023 marked a significant year, recording the highest number of properties sold—399,008 units—since 2013. After 11 years, we are seeing figures that closely match the property market peak of 2011,” he said.

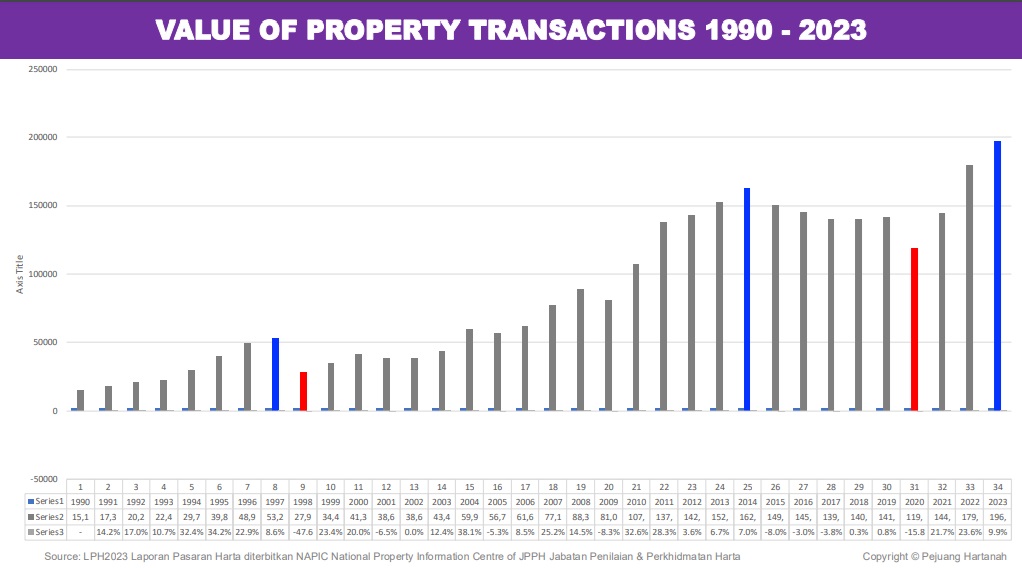

In terms of transaction value, the industry reached RM196.83bil, setting a new record and surpassing the nation’s previous high of RM162bil in 2014.

“As of the first quarter of 2024, a total of 104,297 properties worth RM56.53bil have been transacted,” he said. This figure is higher than last year’s corresponding period.

So is this a sign of a looming boom? Ahyat remains optimistic, citing statistics that suggest a repetitive boom occurs approximately every 18.5 years. The last boom was in 2011, so based on this timeline, Malaysia is due for another in about five to six years. This makes the current period crucial for property acquisition for those who trust in these projections.

However, a word of caution: Long-term real estate investment requires a broader perspective, focusing on property value appreciation across multiple cycles rather than short-term volatility. As with any investment, conducting thorough due diligence is essential, especially for a property that could be an individual’s single, most significant lifetime investment.

(Sidebar)

Risk management strategies for investors

Investors can mitigate real estate cycle risks by investing in Real Estate Investment Trusts (REITs) or real estate exchange-traded funds (ETFs), which are less directly tied to market fluctuations. REITs allow individuals to invest in real estate without owning property outright, generating income through lease payments and asset appreciation. Real estate ETFs provide a diversified portfolio of stocks from real estate companies, developers and REITs, reducing exposure to any single sector downturn. Managed by fund managers, these investments can offer strategic flexibility even in challenging market conditions, sometimes with exposure to global markets, which adds a layer of resilience.

Cash reserves allow investors to seize opportunities in downturns, such as distressed sales or significant discounts from developers, which can yield profitable returns when the market rebounds.

Investors can reduce risk by diversifying across different property types or markets and staying informed of current market trends and economic developments.

Navigating real estate market cycles is much like mastering the art of wave riding. Investors who understand the cycle’s phases, timing and key influencers are better equipped to thrive in the shifting yet rewarding landscape of real estate. Recognising indicators, developing effective strategies, managing risk and taking a long-term view can position investors to ride waves of opportunity, achieving lasting success in an ever-evolving market.

“Recognising where the market currently sits in this cycle can

help buyers and investors forecast potential returns, manage risks and make buying decisions," said Ahyat

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.