Risk & Return

In the residential world, demand and supply are the hero factors, whereas in commercial property, risk fluctuates in tandem with the Malaysian economy – worse conditions mean less purchasing power, leading to lower demand for retail spaces and ultimately lower property value and rental rates. However, the adage higher risks higher returns rings true here, as the lucrative prospects generally offset the gambles.

Less stress on tenant management

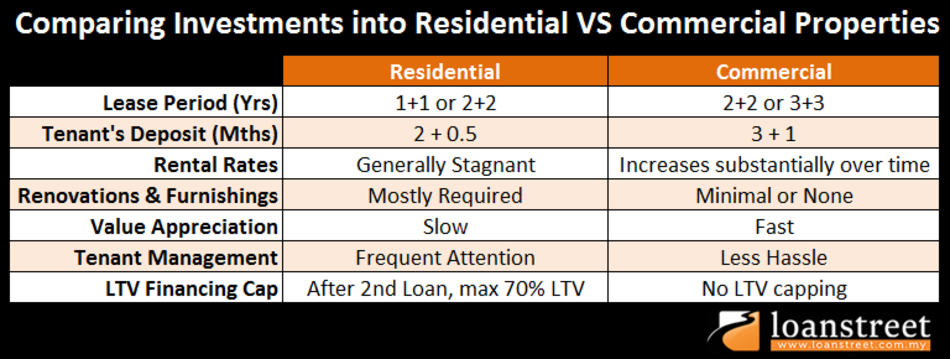

In this area, commercial property investment comes out champion by a long shot. For residential property, furnishings and renovations are pretty much a necessity to rent out your unit in competitive areas. On the other hand, commercial property tenants prefer their units bare, as they usually want to design and renovate them to their liking.

Subsequently, tenant management is much easier, comparatively. Residential property owners often face problems of frequent complaints and runaway tenants leaving outstanding rent and utilities. Commercial property tenants, conversely, generally pose much less problems and are more likely to adhere to the terms of tenancy agreements.

Additionally, if your commercial unit is in a competitive area, tenants would be lining up should your existing one choose to terminate or not renew his tenancy, sparing you the hassle of finding new tenants. Finally, as tenancy periods for commercial units are longer compared to residential ones, you save on agent commissions.

A lucrative market

Yes, in general, property prices have been surging recently, but in the commercial property sector, especially for prime areas, property value appreciation in general is much higher and faster. The reason for this is that for commercial property, rental rates have a direct and more relevant impact on property value, as opposed to the residential sector, where demand and supply play a bigger part.

Additionally, rental rates for prime commercial units shoot up substantially higher and faster than for residential units. It isn’t uncommon today for commercial units’ rental rates in busy areas to revolve around the tens of thousands, many times more than a residential piece of the same square footage in the same area. So, the benefit here is two-fold: higher property value and higher rental rates.

Financing your purchase

If you have ever taken a home loan, you would know that banks in general aren’t particular about the type of property they’re financing, be it apartments or houses. But when it comes to commercial property loans, banks become hyper-selective about the type of property and may give you a lower margin of finance and/or shorter loan tenure based on the property type. If you do get offered a bum deal on a commercial property loan, shop around – different banks tend to like different types of commercial properties, so you might get a better deal at a different bank.

Conclusion

To sum it up, although you stand to gain more in the commercial property market as opposed to residential units, there are many caveats you should look out for, as factors like location, property type and economic conditions have much bigger impact on your investment.