"I'd like to put in an offer!"

Watch this Space by Chee Su-Lin | sulin.chee@thestar.com.my

What happens when your bank valuation is lower than the price negotiated?

If you ever made an emotional bid on a property, and you and the owner went back and forth on the offer, you probably experienced trying to get a loan, and everything going down the drain when the valuation came in lower than the agreed price.

It happened to me twice. After much to-ing and fro-ing, jual mahal-ing, and wooing, we and our potential sellers came to a number that was agreeable to both parties.

Say the owner opens at RM600,000 and you want RM500,000; he finally comes down to RM550,000. You call a few loan officers and they get preliminary valuations, but none of them come to RM550,000. The best one you get comes up to RM500,000.

This means that if the bank gives you 90% of the value, that would only be RM450,000, and you’d need to cough up RM100,000 cash, instead of RM50,000.

Wong: “Based on our experience and records, about 30-40% of indicative values are higher than current market values.”

This is usually an opportunity for you to negotiate. “Hey, the bank only valued it at RM500,000, can we at least meet halfway and agree on RM525,000, so I only come up with RM75,000?’’

In my first experience, the seller came down on the price while I upped the amount of cash. In my second experience, the seller wouldn’t budge. Unfortunately, we had already put down a 2% earnest deposit and were locked in.

Among other things, it made me wonder, why do valuations come in lower? “Market value” is defined in the Malaysian Valuation Standards issued by the Malaysian Board of Valuers, Appraisers and Estate Agents as “the estimated amount for which a property should exchange... between a willing buyer and a willing seller in an arm’s length transaction...” So wasn’t that what our hotly negotiated price was? Market value?

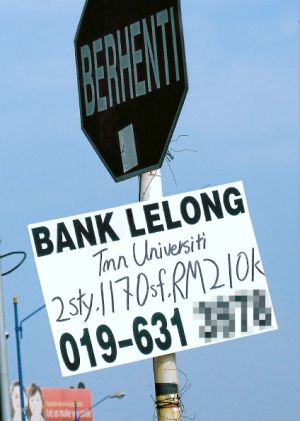

Perhaps banks err on the side of caution, in case properties need to be auctioned off to recover non-performing loans. Also, valuers may be sued for professional negligence if auction results come in much lower than reported.

But in my second experience, after getting several values more than RM100,000 below our negotiated price, I got one at the exact value I needed. So what was the true value? I spoke to a few people in the trade to find out.

Time lag in a hot market

“The banks’ practice is to provide valuers with an ‘indicative value’ (a price that a buyer is willing to buy and to take a loan for from the bank) and see if they can value at that value,” explains VPC Alliance (Malaysia) Sdn. Bhd managing director, James Wong. “Based on our experience and records, about 30-40% of indicative values are higher than current market values.”

Siva: “The phenomenon of valuations coming under negotiated prices always happens in a rising market where the price rise is very quick and steep.”

One reason is because valuers rely on recent transacted prices from the Government’s Valuation and Property Services Department (JPPH). These sales data will be lower than current prevailing market values in localities with active property markets such as Desa ParkCity, Cheras and Balakong along the proposed MRT Line, as well as Puchong, says Wong.

This is because it takes three to six months for the transaction to be completed and for JPPH to put the data together, which means that data could be six month old or older, adds Malaysia Institute of Estate Agents (MIEA) president Siva Shanker.

“So let’s say a property is worth RM600K in January, by July it’s probably worth RM650K, by December it’s almost 700K,” he illustrates. “But in July, the valuer is still valuing at as RM600K, while in December, his value is RM650K when you are trading at RM700K, he’s always behind.”

But if valuations cannot catch up with “market prices”, how do buyers obtain the loans to push prices up? “People have a lot of savings, and they pay anyway, I think,” offers Siva.

Location, location, location

Indeed, when it comes to secondary property in matured locations, sometimes there’s no replacing the house you want.

“I had a client once, she was prepared to pay RM75K with a government housing loan but there had been 10 other transaction going at RM60K, how could I give her a value of RM75K?” illustrates former JPPH director general, Dato’ Mani Usilappan.

“She said, ‘My mother-in-law’s house is behind, and I can leave my baby there, so I don’t mind paying more.’ As long as they can afford to pay the down payment, they don’t consider previous market transactions. Even my son wanted to buy a house and I rejected three or four, because I knew they were not the right prices.”

“This trend happens especially in hot areas like Bangsar Baru, where there are not many sellers and much demand,” agrees Azmi & Co (Shah Alam) Sdn Bhd managing director Nagalingam T.

“And really, in a single taman, say, Bangsar Baru, how many transactions happen in a year? Probably about 10 out of 5,000 houses. Chances are, those 10 people buying the house, they have the money to buy, but that doesn’t mean that it’s the market value. If let’s say 1,000 out of 5,000, then perhaps, but in this case, the market is skewed by who can buy.”

The market is skewed by those who have the money to buy the few houses on sale for high prices in a hot property market, says Nagalingam.

Besides transacted costs, valuers take into account the pricing of new projects in the area. Ironically, loans to buy developer properties are less controlled by comparable transacted prices.

“In the majority of cases, the banks and developers decide on prices of the new property launches without consultation with valuers,” shares James Wong. “In limited cases, banks and developers seek the services of valuers and property consultants to prepare market and feasibility studies. However, for some of the larger banks, they have a valuation unit to assist them.”

“When we apply for loans for our projects, the banks require us to appoint their approved property valuers to provide independent market research reports to ensure the pricing of our properties are within market norms,” agrees property developer Vignesh Naidu of F3 Capital Sdn. Bhd.

“These values are not necessarily relied upon when it comes to pricing our launch though. The loans are obtained most often several months before the properties are launched, hence the prices may be revised higher than as cited in the report. Usually, we look at the response when we first preview, and if the response is good, we will revise the price upwards.”

“Developers do not refer to valuers when deciding the sales price but instead they rely on comparative prices of other projects, market studies and some gut instinct,” agrees another developer who prefers to remain unnamed.

Values received when obtaining a developer's loan are not necessarily relied upon when it comes to pricing during launch, says Vignesh.

Much also depends on the relationship between developer and the bank, however. There have been cases of banks not willing to provide end financing at prices the developer wanted.

Either way, the last few years have seen enthusiastic take-ups of developer properties.

“Now you’ve got a lot of people like real estate investment clubs who buy not for themselves or for long-term investment but to push away once they have a profit,” says Mani. “They group together and ask the developer for a bulk discount so immediately they have profit on paper.”

In fact, launch prices are future prices and don’t include promotions like Developer Interest Bearing Scheme (DIBS) and rebates, says Nagalingam. “So these should not dictate market value.”

“Because the market is on an uptrend, it’s fine but when the economy comes down, there will be non-performing loans, and then real values will come in,” suggests another real estate negotiator active in Bangsar Baru.

‘Flexible’ valuations

Another reason for the disparity between valuations and negotiated prices is the tendency for buyers to go to a few banks with their indicative values to “shop” for maximum values and loans. To compound this, some banks’ credit officers in turn “shop” with their panel of valuers for the maximum values and loans, says Wong.

Another reason for the disparity between valuations and negotiated prices is the tendency for buyers to go to a few banks with their indicative values to “shop” for maximum values and loans. To compound this, some banks’ credit officers in turn “shop” with their panel of valuers for the maximum values and loans, says Wong.

The Bangsar Baru negotiator has also heard of certain bank branches which may be more aggressive to support higher values to seal the transaction. “Some branches have got a lot of money to lend out, which might increase their risk appetite.”

Some Malaysian bankers have requested valuers to value properties for loan purposes above their “market values” as defined in the Malaysian Valuation Standards to keep customers happy, adds veteran chartered surveyor and valuer Dr. Ernest Cheong.

Malaysian valuers may be “compelled” to comply to “get and keep” these bankers’ business. At the same time, Cheong has also heard of valuers being “requested” to undervalue foreclosed properties to be sold by public auction to benefit certain specific parties.The victims of overvaluation and undervaluation cases have gone to Court, resulting in unfavourable judgments against these valuers.

According to Cheong, registered valuers have been known to be encouraged by banks to overvalue or undervalue certain properties.

“Those Malaysian banks which are guilty of such practice should not pressure valuers to manipulate the market values of property, either for loan or auction purposes. If Malaysian Banks want to limit their risk and reduce their exposure, they should lower the lending margin instead. They can reduce from 90% to say 80% or 70%... Malaysian registered valuers on their part should give their true and correct professional opinion and act with integrity and professionalism without fear or favour.”

As for the practice of undervaluing foreclosed properties for public auction, Malaysian banks have the right to “force sell” their defaulting customers’ properties, but they have no right to sell the foreclosed properties below their ‘market value’ as defined in the Malaysian Valuation Standards, states Cheong. Such practices are unprofessional, irregular and unlawful vis-à-vis the National Land Code and Penal Code.

What to do

In my case, even though my final valuation came up to the negotiated price, it might have saved me the 2% earnest deposit, but it lost me RM100,000 in future payments. Before completing on our transaction, our new neighbour told us he’d bought his house for RM100,000 cheaper, only a few months before.

So if I could do it all over again, I would get my loan application and valuation done before binding my price with any payment. Speaking to one or two banks would net at least five preliminary, verbal valuations.

There are even certain websites where you can get transacted sales data yourself (such as http://jpph.info/index.php, and www.ipropertydata.com). Also, ask around the street of your property to know what prices were paid before.

Instead of being a dealbreaker, a lower valuation can be an opportunity for a wiser, more well-informed purchase.