Alex Yeoh, is a licensed financial planner who reckons that financial planning knowledge is one of the biggest investments that each and every one of us should not neglect.

When it comes to property investment there are three commonly asked questions in the minds of most investors.

However, due to various reasoning, regardless of traditional thinking or even for physiological reasons, investors have already set-up some answers to the key questions with regards to investment that can be broken down into three separate parts.

The first question commonly asked is if or not freehold is always better that leasehold? It is undeniable that over long-term periods, freehold properties would be more secure and stable with regards to pricing.

This is mainly due to the freehold title that gives the land ownership for a longer period as compared to a leasehold titled property which only carries a maximum 99 year ownership.

If one isn’t planning on investing for a long period of time (for example 30 years), in cases such as these, leasehold properties could be more appealing.

Why is this so? Well this is thanks to traditional thinking of investors as well as aggressive promotion by property agents, commonly painting a picture that freehold properties are much more attractive and are a key selling point when promoting a particular property.

Due to the aforementioned, freehold properties usually fetch a premium as compared to leasehold properties, though the properties may be identical in nature and located within close proximity.

On the other hand, as an investor one can buy a leasehold property with a ‘discount’ and make your investment worthwhile.

The worthiness of such an investment is based on how much net profit one can earn. Investors should then not only make their purchase decision based solely on property titles but also the upside of a particular investment.

The demand for leasehold properties are evidently lower, thus lowering the purchase price fetched. This however, translates to benefits, by being able to purchase such a property at a lower price and later on one can dispose the property with a lower price as compared to market rates.

An example of such a situation would be two condominiums, located beside each other with similar facilities and size. The freehold unit sells from RM500,000 while the leasehold unit sells at RM450,000.

A few years down the road, the units appreciated in price to RM900,000 and RM810,000 respectively, which property would give you an absolute return? The answer is either as both properties enjoy up to 80% in capital appreciation, though the leasehold unit is sold RM90,000 cheaper.

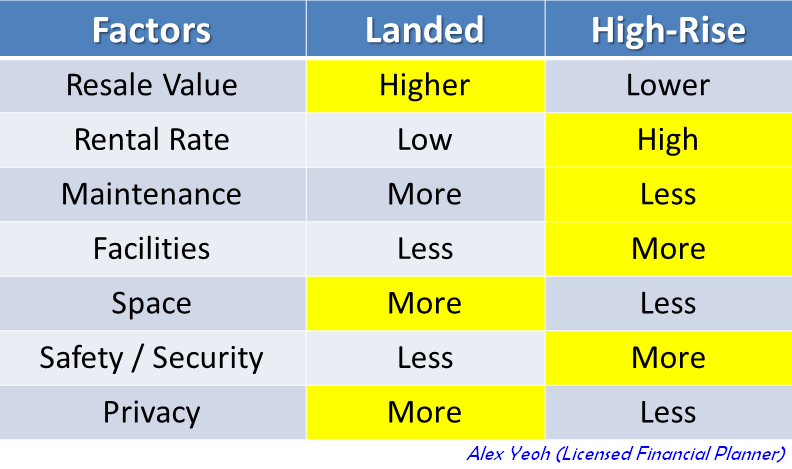

The next common myth is that landed property always provides better returns as compared to high-rise properties.

From the investment perspective, there are two types of returns, namely rental returns as well as capital gains. Having said so, both these types of returns usually come hand-in-hand. This is due to higher rental rates making a property more valuable and thus appear more attractive.

Generally, landed properties can are able to achieve higher capital gain or resale value, while high-rise properties can generate higher rental rates. It boils down to what kind of return you are looking at. Let us consider the pros and cons for both landed and high-rise properties as shown.

Some people may argue that the high maintenance fees for high-rise properties eat into investments return. This is inaccurate as this imposed fee is meant to provide various equipment and facilities such as 24-hour security, building refurbishment, gardening as well as housekeeping.

Today most gated and guarded landed properties with facilities are required to pay maintenance fee. Paying maintenance fee is actually a plus point as when a property is well maintained, it will hence fetch higher resale values upon selling.

The final myth that is common amongst investors is that primary property is always better than secondary property.

Many investors prefer buying newly launched properties simply due to common belief that new is better. However, from an investment perspective, a new property requires long holding periods that can reach up to three years before keys are handed by developers over to respective home owners.

During the construction stage of a property, the financial commitment and debt servicing ratio assessed by banks would be locked, meaning that no cash inflow from that particular property can take place.

This can jeopardise the ability of an investor to secure another loan just in case another good investment opportunity may arise within that period.

On the flip side, for a sub-sale property investment, aside from the disadvantage of requiring at least a 10% down payment, an investor can free their cash flow once he or she is able to secure tenants to generate rental income.

This rental income is recognised by banks as part of an individual’s income if the need may arise to secure another bank loan.

In conclusion, property investment involves large sum of money as well as financial obligations. The method of optimising one’s return from various individual properties will differ and it is crucial to pave one’s investment pathway to a more successful one.