by imoney.my

Refinancing allows you to pay less interest on your property, to service less of a monthly home loan installment if you’re tied for cash, or to borrow some cash using your home as collateral, and based on its new, higher valuation.

Home loan refinancing has been popular as a loan option for home buyers in US and UK. For example, for US mortgage lenders Wells Fargo and JP Morgan, refinancing made up between 60% to 75% of all home loans in the past year, according to a Reuters article in The Star.

In Malaysia, refinancing is still not yet as popular, although property prices have increased substantially while interest rates have gone down, with bank lending spread having decreased substantially below the base lending rate (BLR). These factors would make refinancing an attractive form of credit for Malaysians.

Of course, you should try to refinance after your lock-in period is over, when you don't have to pay a penalty for paying off your loan. Also, consider that the cost of a new loan agreement, which comes with valuations costs, stamp duty, legal fees and other disbursement costs might come up to 2% to 3% of the refinance amount.

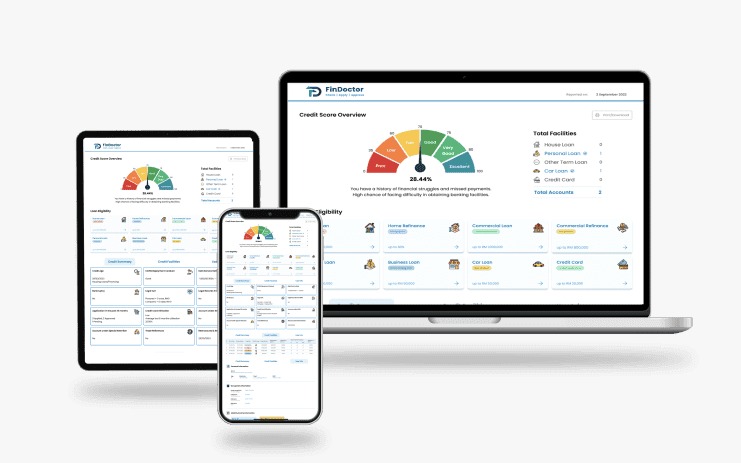

imoney's home loan refinancing calculation tool lists out mortgage deals which are better than your current mortgage, after you key in your outstanding loan amount, remaining loan period and interest rate of your existing home loan.

iMoney.my compares between the various loans, savings and insurance schemes available in Malaysia.

Read more:

How do people make money from real estate?

How to ‘make money’ from your home loan

Fixed rate vs variable rate home loans: Which are better?

What to do if you can’t repay your loan