With the first half of the year over, major shopping malls and commercial centres are seeing a return to their usual foot traffic, indicating higher retail sales and a return to normalcy as the public comes to terms with the recent upheavals.

The national economy recorded a growth rate of 5.0% in the first quarter of 2022, with the retail industry itself being no exception. It recorded a growth rate of 18.3% in sales as compared to the same period in 2021, higher than initial expert estimates.

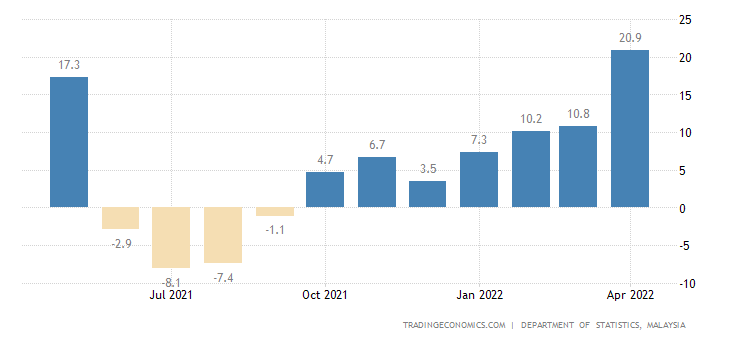

The pandemic’s closure of supermarkets, retail outlets and malls has caused the retail industry to suffer significantly in comparison to other property subsectors. Independent global property consultancy Knight Frank reported that in the third quarter of 2021, the retail industry had recorded a 27.8% decline in sales. Another factor to be taken into consideration is the boom of e-commerce, which has facilitated a reimagining of the shopping mall experience to improve foot traffic.

For instance, Suria KLCC’s Safe Space highlights the mental toll of the pandemic with its new exhibit.

However, the recovery of the retail industry is also accompanied by decreased sales for selected sub-sectors, that had enjoyed increased sales during the pandemic and are returning to pre-pandemic level sales according to a report by the Retail Group Malaysia.

Sub-sectors that recorded a positive growth rate during the first quarter of 2022 include the department store and supermarket, children and baby products, personal care, furniture and furnishing, home improvement and electrical subsectors.

The highest growth rate achieved was from the fashion and fashion accessories sub-sector, which recorded a 52.1% in growth rate, while the lowest growth rate came from supermarket and hypermarket sub-sectors, which returned to pre-pandemic levels.

Future outlook

During the second half of 2021, the confidence of retail sector investors remained low. The lockdown had been followed by multiple closures of brands, both local and international.

In April 2022, the Department of Statistics Malaysia reported that retail trade increased to 20.9%, recording a seven-month straight increase in retail sales. Retail Group Malaysia projects a 25.7% average growth rate for retail sales during the second quarter of 2022.

Retail property investors will be able to keep an eye out for sub-sectors such as department stores and supermarkets, mini-markets, convenience stores and cooperatives, fashion and fashion accessories, children and baby products, pharmacies and personal care. These sub-sectors are expected to continue their rate of growth, while supermarket and hypermarket operators are estimated to have a negative growth rate for the second quarter of the year.

To alleviate rental concerns, the United Kingdom (UK) markets have begun exploring innovative ideas for retailing, such as the implementation of sustainable rents.

According to a report on the retail property outlook 2022 by Knight Frank, the method includes a change in the way retail property is assessed and valued, as some occupiers can afford to pay more rent than others. Occupiers thereby pay different rents according to what they can afford, recognizing the value of a harmonic team in making commercial destinations a success.

As the retail property landscape continues to evolve, operators will have to evolve with it through sustainable and equitable means.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.