WHEN purchasing or refinancing a property in Malaysia, there are many different attributes (e.g. Lease, Subdivision, Land Type) the property can have. Each requires different treatment during the conveyance process, and can even affect your housing loan / mortgage application. This article debunks and summarises everything you have ever wanted to know about types of property attributes in Malaysia, and how it will affect your purchase and refinancing decisions.

Freehold vs Leasehold

Leasehold land belongs to the state and is leased out to an “owner” for a number of years. Towards the end of a lease, owners are required to pay a fee to extend the duration of the lease. Freehold land on the other hand belongs to the owner (the purchaser) indefinitely.

Additionally, during a sale and purchase process, consent is required from state authorities (Land Office) before the transfer can proceed. The state can withhold approval for any number of reasons. Due to this additional step, it can take much longer to buy or sell a leasehold property.

For these reasons, freehold properties are usually more expensive than similar spec leasehold properties.

| Leasehold | Freehold |

|---|---|

| Land belongs to the state, leased to owner for a number of years | Land belongs to the owner |

| At the end of the lease, owners must pay to extend the lease | Ownership is indefinite |

| Requires state consent (obtained at land office) to transfer ownership | Does not require state consent to transfer ownership (except in certain specially earmarked properties) |

| Most banks will not finance a property if the lease has less than 30 years to go | No question of existing lease duration for home loans / mortgage |

Subdivision of Title

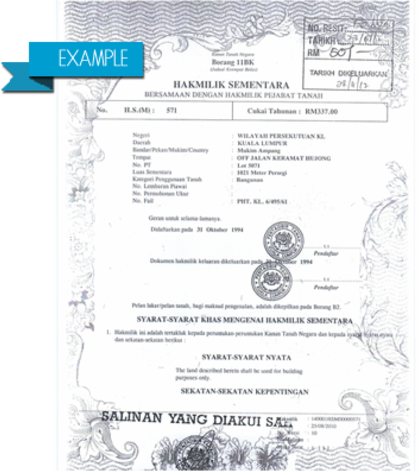

All properties have a title deed which denotes the owner of a property. During the construction and development phase, it is likely that an entire swathe of land will fall under a single “Master Title”.

But typically, multiple houses or apartment units would be built on the land and sold off individually. So ideally, the “Master Title” would be subdivided into multiple smaller titles before being sold to individual purchasers. For landed properties, these are known as “Individual Titles”. For high rise properties, these are known as “Strata Titles”. Once subdivided, to transfer ownership, a Memorandum of Transfer (MoT) would be filed at the Land Office. The purchaser’s name would appear on the title deed itself, making them the new rightful owner of the property.

However, in practice, it is common for developers to sell the properties still on Master Title, and where subdivision may happen only many years later. In such cases, to buy/sell, instead of a MoT at the Land Office, a temporary Deed of Assignment (DoA) would be filed at the High Court. Based on the Master Title, the developer is still the rightful owner. However, the developer has “assigned all their rights” over individual parcels / units within the land over to the purchaser. Do note that once the individual / strata titles are out, the official transfer of ownership process (using the title deed) as described above will still have to take place as per standard practice.

| Master Title | Individual / Strata Title |

|---|---|

| Developer is the rightful owner. Uses DoA lodged at high court to assign rights of a property over to a purchaser. | Purchaser is rightful owner. Uses MoT to change the owners name on the property title deed at the Land Office. |

| A chain of Sale & Purchase Agreements (SPA) and DoA leading all the way back to the original sale must be used to prove latest ownership. | Name on property title deed is sufficient to prove latest ownership. |

| Most banks will not finance a property if it is still on Master Title 10 years after completion. | No issue with financing. |

Malay Reserve Land

There are certain properties which have “Malay Reserve Land” status (Note: This is not the same as “Bumi Lot” properties). These properties cannot be transferred to a non-Malay under any circumstances. And just as in Leasehold properties, state consent has to be given for transfer.

Conclusion

If you are intending to purchase or refinance a property, it is important to know the kinds of attributes your property has. Once you have ascertained the property you want to purchase, use this as a guide and our home loan comparison tool together to understand the kind of housing loan or commercial property loan you are able to obtain.

>> Loanstreet.com.my is a website enabling one to compare and apply for loans online.