The increase in e-commerce activities and technology adoption gave rise to the demand for warehousing.

By Joseph Wong

Sabah, Johor and Penang are the next-best locations to invest in, other than Klang Valley

With an obvious increase in the general property market activity in 2022, there is also a general increase in investments across the board in almost all sub-sectors, possibly signifying a full recovery from all the negative impact of Covid-19 and the subsequent movement control orders (MCOs).

Certainly, there is optimism among property investors in this period of economic recovery. There are many indicators that the property sector is poised for a bounce-back, albeit at a slower and steady pace as many are still cautious after being burnt by the disruptions.

With the renewed interest, one of the more prominent questions is where commercial property investors are looking to venture in the near term?

Independent global property consultancy Knight Frank, in releasing its Malaysia Commercial Real Estate Investment Sentiment Survey for 2022, gives an inkling.

Carried out across the Malaysian commercial property industry, the purpose of this survey is to comprehend current sentiments towards the commercial real estate sector and where it may lead in the near future.

Among the factors affecting this sector include the present low interest rates (OPR at 1.75% to 2.00% at the time of writing), the multiplier effect of ongoing mega projects, and continued foreign direct investment (FDI) into Malaysia.

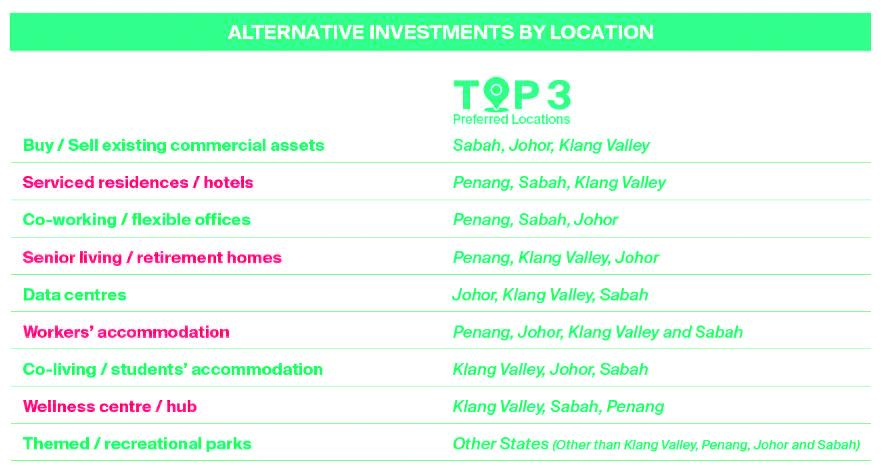

Figure 1 Alternative Investments by Location

According to Knight Frank Malaysia research and consultancy executive director Amy Wong, people appear to have a better risk appetite for alternative investments in the next two to three years.

The survey revealed almost equal interest to participate in serviced residences, hotels, co-working and flexible offices, senior living and retirement homes as well as data centres. And they are not just focusing on Klang Valley, location-wise, as the survey points to Sabah, Johor, and Penang among the popular destinations for these alternative investments.

Figure 2 Predictions on the outlook for the commercial real estate market

In regards to capital value, more than two-thirds of the respondents (76%) expect the industrial and logistics sub-sectors to enjoy capital value appreciations in 2022, with slightly more than half the respondents (57%) also anticipating the same for the Healthcare sub-sector.

In terms of yield performance, 68% of respondents expect yields to increase in the Logistics sub-sector, with anticipated higher yields for Healthcare and Industrial sub-sectors.

Predictably, these opinions are comparable on increase in rents, with rents of Logistics properties expected to increase, according to 64% of respondents; and 53% also agreeing that increases are expected in the Industrial sub-sector, in line with growing demand for space in these 2 sub-sectors.

There are similar expectations in the occupancy rate for the same two sub-sectors, and it is worth highlighting that there is a predicted reduction in occupied office space, due to the reality of continued pressure on occupancy rates and rents as supply continues to outpace demand. These views are unsurprisingly echoed in the predictions on the market itself.

“Through this survey, which highlights the Logistics and Industrial sub-sectors as the favourites, respondents have expressed their confidence that these sub-sectors will be the quickest to recover within the next twelve months, along with the Healthcare sub-sector. The traditional sub-sectors of Hotel / Leisure, Office, and Retail are seen by respondents as a long-term play,” said Wong.

As the nation navigates the new economy in a somewhat changed world that is anticipating further disruption, there is a need to cultivate resilience in real estate portfolios to anticipate risk and minimise disruption in an increasingly complex world, said Knight Frank Malaysia group managing director Sarkunan Subramaniam.

“The growing awareness and adoption of environmental, social, and governance (ESG) frameworks in the real estate industry will help drive the value of sustainable real estate into the future,” he said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.