BY: National House Buyers Association

THE National House Buyers Association (HBA) is glad that the research report by Khazanah Research Institute (Khazanah Research) released on Aug 24, 2015 titled “Making Housing Affordable” shows that average house prices in Malaysia are more than four times the median income, which makes such properties to be considered as “seriously unaffordable”.

HBA has been raising alarm bells for many years that prices of property in Malaysia have risen beyond the reach of the majority of the rakyat, both in the lower and middle income segments and unless serious measures are taken by the Government, an entire "Homeless Generation" comprising mainly the lower and middle income and the younger generation will not be able to afford to buy their own homes and this can bring about social problems for the country.

For too long, the Government has listened to the advice from business groups with vested interest; that there is no problem with the housing sector in Malaysia and prospective house buyers are still able to buy their dream homes. These business groups have openly touted that property prices of up to RM500,000 are deemed affordable for first-time house buyers and for house buyers who are upgrading their existing property, the price that is deemed affordable is up to RM1mil.

This report also confirms what HBA has been saying in the past that the issue of housing affordability is only a recent phenomenon as there were much less complaints about property affordability compared to say 10 years ago in 2004.

According to Khazanah Research, the Malaysian all-house price had grown at a compounded annual growth rate (CAGR) of 3.1% from 2000 until 2009. However, between 2009 and 2014, it grew at a CAGR of 10.1%, which was almost three times more than the growth from 2000 to 2009. The Government must conduct an in-depth analysis and investigation as to what caused the sudden spike in property prices during this short period.

There is a direct relationship between prices of completed properties (secondary market) and prices of new properties launched by developers. Whenever there is an increase in the secondary market, developers will launch new properties at a premium to the prices offered in the secondary market. Conversely, whenever developers launch new projects at premiums compared to the secondary market, the prices of the secondary market will be further pushed up and this creates a vicious cycle.

Price increase in one area can spill-over to the surrounding areas and cause the prices of such nearby locations to be pushed up. Thus an increase in property prices in central Kuala Lumpur can push up prices in say Cheras, which can push up prices of properties as far as Kajang and beyond. As a result of the sudden spike in property prices between 2009 and 2014, the lower and middle income groups find it very difficult to buy their own homes in many locations, not just in urban Kuala Lumpur.

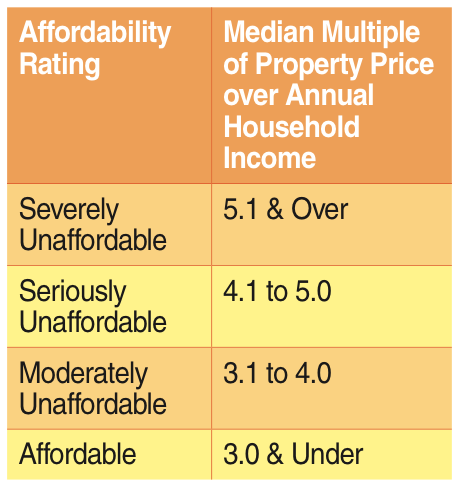

The Government should also define what constitutes "affordable property" and the type of property. Affordability should be benchmarked against the annual household income of the respective buyers. The international accepted ratings of “Affordability Rating” used by various reputable bodies such as World Bank, United Nations and even Khazanah Research are as follows:

HBA recommends that "affordable property" be priced between RM150,000 and RM300,000 with minimum built-up of 800 sq ft (with two bedrooms ) to 1,000 sq ft (with three bedrooms). This is in stark contrast with what housing developers have been touting as affordable, which ranges from RM400,000 (for first-time house buyers) and up to RM1mil (for up-graders). Whilst there are new properties launched below RM500,000, most of these properties are one-room studio units with built-up of 450 sq ft to 600 sq ft and are not suitable for house buyers who wish to start a family or those with existing family.

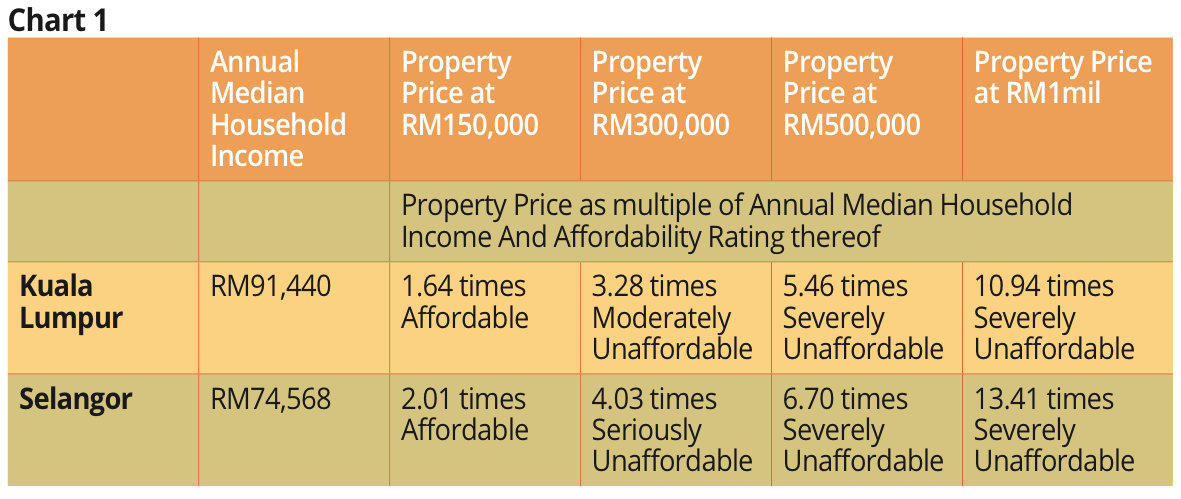

The Household Income and Basic Amenities Survey 2014 by the Department of Statistics revealed that Median Monthly Household Income for 2014 in Kuala Lumpur and Selangor was RM7,620 and RM6,214 respectively. Annualised, this translates to RM 91,440 for Kuala Lumpur and RM74,568 for Selangor. The Affordability Rating for property priced between RM150,000 and up to RM1mil benchmarked against the said median annual household income is outlined in Chart 1.

What the developers claimed to be affordable is definitely not affordable. Even HBA’s recommendation for properties costing up to RM300,000 slipped to the category of "moderately unaffordable" to "seriously unaffordable", albeit slightly. Hence there is a pressing need for affordable properties to be priced at between RM150,000 and RM300,000 to cater to the larger needs of the rakyat, which fall in the lower and medium income groups.

After the main reasons for properties becoming unaffordable has been identified and affordability range determined, the Government must implement concrete, holistic and sustainable measures to resolve this problem. Khazanah Research made the following preliminary recommendations to resolve this issue of property affordability:

(i) Develop measures to improve the efficacy of the construction industry’s delivery system to supply housing at affordable prices.

This involves improving the efficiency and efficacy of the property developers so that it is more cost-efficient and profitable to build affordable properties.

(ii) Developing measures to reduce pressures leading to rapid house-price escalation.

This involves imposing a moratorium period whereby house buyers cannot sell their affordable properties within the first five years of ownership.

(iii) Developing measures to plan for a steady supply of housing at affordable prices.

This is to ensure that the right numbers are built at the right places at the right time. In order to match this steady supply to demand efficiently, detailed information of demand and supply of housing locations will be required.

We understand that the "Making Housing Affordable" report represents the first of a series of reports which aims to investigate and resolve the issue of housing affordability and more recommendations will be put forth by Khazanah Research. Hence we shall refrain from commenting on the proposed measures until we see a more complete picture.

In conclusion, although this honest assessment of the current situation is a few years late, it is never too late and represents a good start. After all, it is said that the first step towards solving any problem is to firstly admit that there is a problem that needs to be fixed rather than suffer the denial syndrome. It is hoped that more recommendations will be put forth and the Government will have the will power and courage to do what it takes to tackle this problem.