It’s that time of year again – income tax filing season – when we weigh our incomes, search for receipts of tax-deductible purchases, and file our dues to society with the revenue board.

For property investors, landlords (or landladies), or anyone else who earns an income through property rental, StarProperty.my presents TAX TALK! If you consider yourself a property investor or a landlord (or landlady), then this Tax Talk is for you!

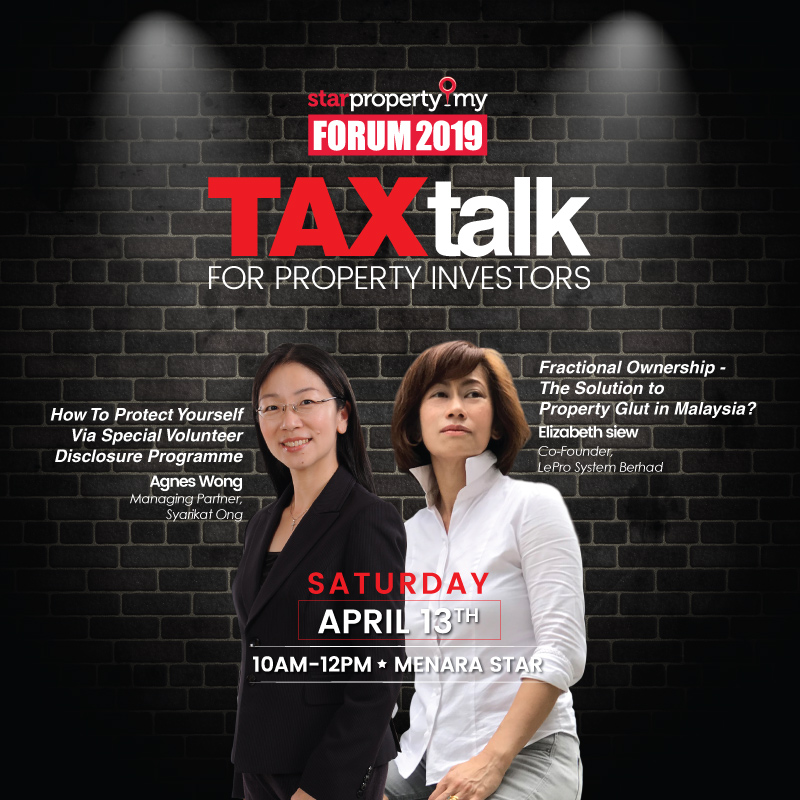

This first-of-its-kind seminar will be held at Menara Star’s Cybertorium on April 13th (Saturday) from 10am to 12pm. Renowned speakers, Agnes Wong and Elizabeth Siew, will be speaking on the latest developments in taxation and property investment to help you make the most of your income tax filing this year.

StarProperty.my’s Tax Talk will feature Agnes Wong, a tax consultant and renowned public speaker, speaking on the subjects of rental income taxation and protecting your interests by taking advantage of the Inland Revenue Board’s latest tax amnesty initiative – the Special Voluntary Disclosure Programme (SVDP).

Meanwhile, Elizabeth Siew, a real estate lawyer turned technopreneur, who is also Malaysia PropTech Association deputy president and Asia Proptech’s Malaysian chapter chairperson, will be speaking on the topic of fractional ownership and how this novel form of investment could be a viable solution to the nation’s current property glut.

Is rental income even taxable? According to Section 113 of the Income Tax Act (1967), yes it is – and always has been since this Act was legislated – but something is very different about this year’s income tax month.

In line with the federal government’s initiative to provide Malaysians with affordable housing – and since the Inland Revenue Board’s (IRB) public ruling issued on December 19th, 2018 titled “Income from Letting of Real Property” (No.12/2018), rental income amounting to less than RM2,000 per residential property will be subjected to a special time-limited exemption of 50% for up to three consecutive years.

Register here!