PETALING JAYA: The property market has faced various challenges along the road, from numerous financial crises to a sluggish market encumbered by overhang units.

These pale in comparison to the Covid-19 pandemic, which ushered in an unprecedented degree of uncertainty into the property development landscape. As is the nature of property development, astute town planners and home builders alike understand the importance of making provisions for the long term.

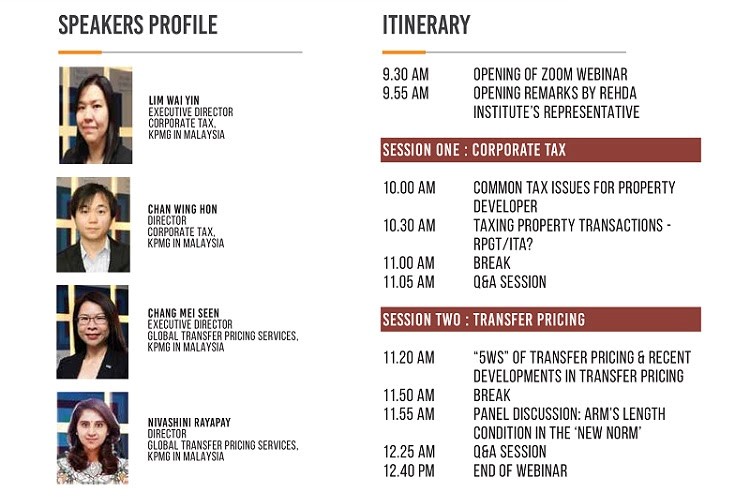

With the new normal in place, there are bound to be questions on adapting and navigating across the unknown. With that in mind, the Real Estate Housing Developer Association (REHDA) is inviting property developers to partake in a webinar themed: The Malaysian Tax Lens in the New Norm for Property Developers.

The event seeks to bring clarity to the immediate, long term tax and regulatory impact on the developer’s strategies moving forward.

These sessions will be presented by a line-up of accomplished KPMG experts who have extensive backgrounds in taxation. The event will be held on March 22 via Zoom. The registration fee is RM138 and seats are limited. Interested participants can register at register@rehdainstitute.com.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.