Contributed by Lai Chee Hoe

Now that we have examined how share units were allocated in last week’s article dated February 15, 2025, we will now look at how share units correlate with the payment of charges. Pursuant to Section 36 of the Strata Titles Act 1985, share units determine both the voting rights of proprietors and the proportion of contributions payable by each proprietor as levied by the Management Corporation.

Voting rights will be addressed separately, as we are currently in discussions with JKPTG on balancing voting rights with the absolute amount payable in relation to charges. In brief, the discussion revolves around whether voting rights should be increased or reduced in proportion to the actual rate of charges payable.

Rates of charges are fluid

While share units are fixed, the rates of charges are always subject to change.

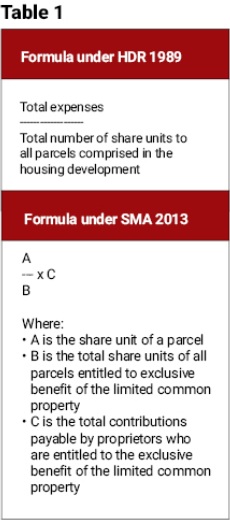

In determining these rates, one can refer to the formula provided in the 5th Schedule of Prescribed Schedule H of the Housing Development (Control and Licensing) Regulations 1989 or Section 65 of the Strata Management Act 2013 (SMA 2013), which, in summary, is as follows in Table 1:

The calculation essentially divides the total expenditure (or contributions payable) by the share units. If one were to adopt a single fixed rate, this would mean dividing the total expenditure of the entire strata scheme by the aggregate share units of the entire development. A single rate is fair when dealing with a single building where all parcel types share the same facilities and common property. This principle was upheld in the case of Muhamad Nazri Muhamad v JMB Menara Rajawali and Anor (CA) [2019] 10 CLJ.

However, in a mixed-use development, a fixed rate may no longer be equitable, as it does not account for the exclusivity of certain common properties granted to specific components. For example, commercial shop parcel owners—who do not have access to facilities exclusively designated for residential use, such as a swimming pool—may still be required to contribute to the maintenance costs of these facilities.

That said, this does not mean that commercial parcel proprietors are exempt from all payments. In any strata scheme, at the very least, expenditures related to maintaining the entry and exit points of the circular road, landscaping and the hiring of cleaners and security personnel managing the shared areas must be borne by all components.

Prior to June 1, 2015, charges were generally applied at a single flat rate, as the pre-amendment Strata Titles Act 1985 and the Building and Common Property (Maintenance and Management) Act 2007 did not provide flexibility in determining payment structures.

Post-June 1, 2015, the Strata Management Act 2013 (SMA 2013) has introduced greater flexibility in determining charges for strata schemes. Under the current framework, different rates of charges may be implemented if:

(a) Parcels have significantly different uses;

(b) Certain common properties are exclusively used by one component;

(c) There is a provisional block; and/or

(d) A subsidiary management corporation has been formed.

How is expenditure apportioned?

Beyond apportioning expenditures to parcel owners who exclusively benefit from specific facilities (for example, a swimming pool reserved for residential parcel owners), some costs are shared across all components. These shared expenditures can be allocated through several methods, including:

(a) Actual headcount (such as the number of cleaners/security guards assigned to an area);

(b) Strata area of a component (eg maintenance costs for circular roads and fire-fighting provisions);

(c) Number of floors served (eg lift maintenance costs);

(d) Actual usage (eg, utilities and EV charging); and/or

(e) Location of the common area (eg rooftop maintenance).

Apportionments must be applied fairly across all parcel owners within the same component who enjoy the same facilities. The principle should be based on entitlement rather than consumption. This means that regardless of whether an owner uses the common property, they remain responsible for contributing to its maintenance as long as they are entitled to access it.

The just and reasonable test, established in the Pearl Suria case, serves as the benchmark for determining a fair budget. This test reinforces the importance of basing budgets on actual or expected figures, rather than arbitrary estimates. Actual figures can be derived from the previous year’s audited accounts, while expected figures may be based on existing contract sums.

The implementation of different rates of charges has been reaffirmed in Aikbee Timbers Sdn Bhd and Anor v Yii Sing Chiu and Pearl Suria Management Corporation [2024] 3 CLJ 177. We welcome this decision, as it aligns with the original intent of the SMA 2013 drafters.

At present, the grounds for implementing variable rates of charges are exhaustive, but discussions are ongoing about introducing more robust provisions within the SMA 2013 to accommodate different payment structures. This may include fixed discounts for government infrastructure-related parcels.

Body in determining Charges

We also propose placing sole responsibility for determining charges on the Developer, Joint Management Body (JMB) or Management Corporation (MC). Charges should accurately reflect the actual and expected expenditure of a scheme.

To set aside charges, one must prove in court that the charges introduced through a general meeting are either excessive, inadequate or not reasonable.

These are the same tests applied in Singapore and New South Wales. By providing clearer parameters, we aim to reduce the burden on courts when determining a rate for a scheme, ensuring that decisions serve the best interests of the strata community.

This approach aligns with the self-regulation principle, allowing each strata scheme to decide its own apportionment, provided it is fair and reasonable. Given that each strata scheme is unique, we trust that the JMB/MC—who best understands the scheme’s needs—can make informed decisions that ultimately benefit strata proprietors.

We believe that considerable weight should be given to the charges introduced within each scheme, ensuring they are respected and upheld unless proven otherwise.

Charges must be supported by budget

If absolute authority is given to the developer/JMB/MC to determine charges, their statutory duties must also be strengthened. We propose making it mandatory for developers, JMBs and MCs to:

- Furnish a yearly budget reflecting actual and expected expenditures and/or

- Table a budget at general meetings, allowing proprietors to review and scrutinise it.

If any proprietor disagrees with the budget, they should have the right to:

- Submit a written request for reconsideration or

- Lodge a private motion to amend the figures, apportionment method, or rate of charges payable.

In conclusion, determining rates of charges is distinct from the assignment of share units and the two should remain independent of each other.

While recalibrating share units approved over the past 30 years may seem appealing, we do not consider it a viable option, given that a fixed formula was only introduced on June 1, 2015.

Furthermore, we do not support adopting the relativity principle, where share units are assigned based on expenditure apportionment upfront. Instead, we believe that expenditure and apportionment should remain flexible. As long as they are fair and reasonable, they should be given considerable weight.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.