Contributed by Lai Chee Hoe

The Strata Management Act 2013 (SMA 2013) came into force in most of the states within Peninsular Malaysia on June 1, 2015. What is also significant is that it sought to provide a uniform share unit formula amongst the different states within the Peninsular.

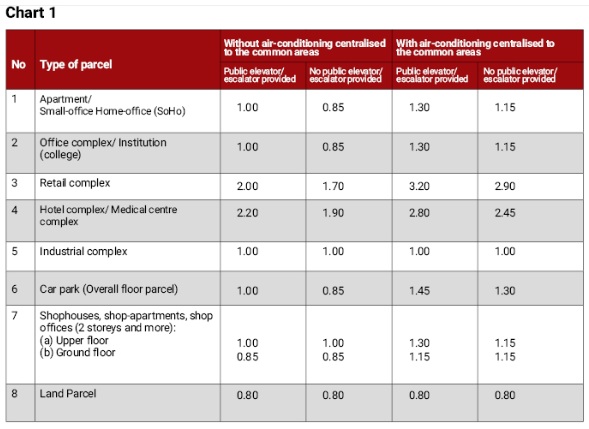

The formula provided in the First Schedule of the SMA 2013 became the primary guide, which was subsequently adopted by various states. For example, in the Federal Territory of Kuala Lumpur, the Strata Titles (Federal Territory of Kuala Lumpur) Rules 2015, which was subsequently revoked and replaced by the Strata Titles (Federal Territory of Kuala Lumpur) Rules 2019], adopted the table (with some variation) which came into force on June 18, 2015. The current share unit formula used largely by most of the states within Peninsular Malaysia is set out in Chart 1.

It was introduced to standardise the formula across different states within Peninsular Malaysia and it is assumed to be the most equitable formula of its time. In many states, it is mandatory to use the share unit formula when one applies for the certificate of share unit formula to the Director of Land and Mines.

Nevertheless, if the default share unit formula is found to be inequitable, the director may determine an alternative share unit formation that is equitable, pursuant to Rule 3(5) of the Strata Titles (Federal Territory of Kuala Lumpur) Rules 2019.

Once assigned, the approved share units are fixed. Amending the approved share units requires filing a court application. The burden is on the applicant to demonstrate to the court that the share units allocated were inequitable.

In assigning share units, the key component in determining share units is floor area. In principle, for a strata parcel, the bigger the built-up is, the greater the share units. Conversely, for a landed strata property, the land area is the determining factor. The bigger the land, the greater the share units assigned.

The fixed share unit formula in Chart 1 assumes that for parcels of similar size, a commercial parcel will generate twice the frequency of use of common facilities and common property compared to other parcel types, due to its higher likelihood of attracting more human traffic. The fixed share unit formula is certainly useful if one deals with a single building comprising parcels of different use.

As a strata scheme expands in size and usage, the formula may become less applicable, as the assumption of frequency of use is quickly invalidated, particularly in cases involving an en-bloc parcel with no shared facilities, a stand-alone building without shared facilities, a building constructed in phases, or a mixed development with minimal shared facilities.

What alternative formulas are available?

Before June 1, 2015, several methods were used to assign share units.

If a strata scheme consists of a single-use parcel, either the selling price or the floor area can be used. However, using the selling price as the primary parameter does not uphold the principle of equity, as it is too arbitrary. Selling prices can fluctuate based on the time of sale, such as early bird discounts, or may be intentionally marked down for sales to associated parties..

For mixed-use developments, if a strata scheme comprises parcels of different uses, one can refer to the internal circulars issued by the Land and Mines Offices of various states. For instance, Selangor provides a ratio of 1:4:5:5:5 for residential, office, retail, car park and industrial respectively.

Expenditure front-loaded share units

Another type of formula prioritises expected expenditure before assigning share units. The estimated budgeted expenditure is then apportioned based on the frequency of use of common property and/or common facilities.

The principles underlying this method can be found in the Fourth Schedule of the Sarawak Strata (Subsidiary Titles) Ordinance 2019, where share units are assigned based on the equality or relativity principles. The equality principle means that share units are assigned equally, taking into account:

- How the strata scheme is structured;

- The nature, features and characteristics of the parcels included in the scheme; and

- The purposes for which the parcels are used.

The relativity principle defines the relationship between parcels by referring to one or more relevant factors. Moreover, the weighting factor is variable and the weighting factor depends on the strata area and the maintenance cost, proportional to the expected use or benefit for each user group. The factors to be considered are:

- Total strata area;

- Common areas exclusively used by each group;

- Total area of the strata scheme;

- Frequency of usage;

- Human traffic; and

- Risk factor

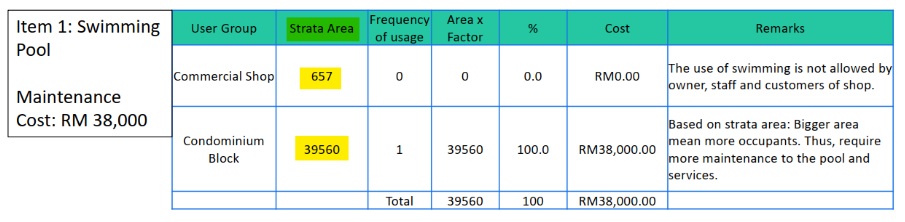

Examples of the calculation are illustrated below:

The weighting factor is determined through the allocation of expenditure based on the frequency of use factor as see below. At first glance, the expenditure front-loading method enhances the principle that share units represent voting rights. However, it relies on several assumptions, including:

- The estimated expenditure prepared in advance is accurate and remains unchanged;

- The usage of common facilities remains consistent; and

- The usage of parcels remains the same.

This method may become inequitable when:

- Additional expenditures are assigned to only one component (e.g., EV infrastructure for commercial parcels only);

- The use of common property is altered (e.g., converting landscaped areas into EV charging bays); or

- The use of a parcel changes (e.g., an office being repurposed as an institution).

As of January 1, 2024, the state of Sarawak has also adopted the share unit formula table used in Peninsular Malaysia as an additional method for calculating share units. This is reflected in the Seventh Schedule of the Land Surveyors Ordinance 2001, as amended by the Land Surveyors (Conduct of Cadastral Land Surveys) (Amendment) Rules 2024.

* If you have any specific subject matter you feel strongly about which requires amendment, kindly email to info@cheehoe.com OR izzah@kpkt.gov.my

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.